December 18, 2021

illinois withholding allowance worksheet how to fill it out

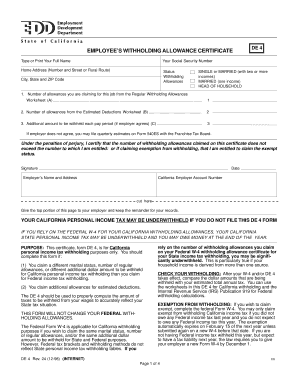

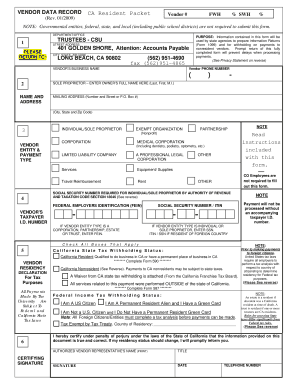

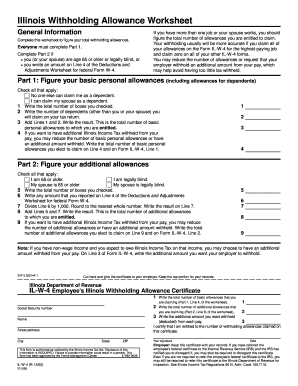

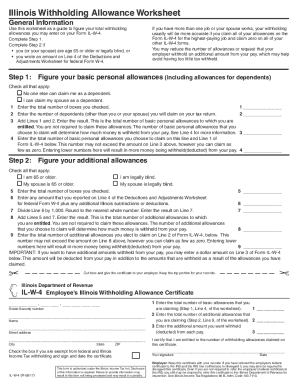

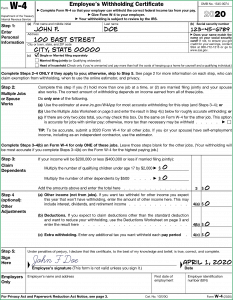

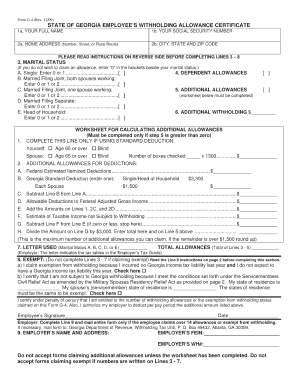

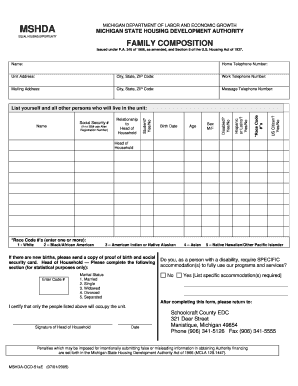

Complete Step 2 if you or your spouse are age 65 or older or legally blind or you wrote an amount on Line 4 of the Deductions and Adjustments Worksheet for federal Form W-4. No matter what other portions of the form you must fill out this one is required and should be fairly straightforward unless youre not sure which filing status to choose.  2018 Form W 4P Illinois. Filing jointly for that year would be transferred into a splashboard allowing you to enter the number from line of! As you may know, Form W-4 is used to determine your withholding allowances based on your unique situation so that your employer can withhold the correct federal income tax from your If your total income will be between $71,201 and $179,050 ($103,351 to $345,850 if married filing jointly), enter 1 for every 2 dependents (for example, enter 0 for 1 dependent, 1 if you have 2-3 dependents, and 2 if you have 4 dependents). withholding agent withholding agent's name address (number and street, po box, or pmb no.) This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/2\/2c\/Fill-Out-a-W%E2%80%904-Step-18.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-18.jpg","bigUrl":"\/images\/thumb\/2\/2c\/Fill-Out-a-W%E2%80%904-Step-18.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-18.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved. WebComplete How To Fill Out Employees Illinois Withholding Allowance Certificate Form online with US Legal Forms. Each employee must complete a Form W-4 when beginning work at ISU. If the employee qualifies and wishes to continue being exempt from federal income tax withholding, the employee must complete a new Form W-4 and submit it the Payroll Office by the deadline indicated in the notification. 1 _____ 2 Write the number of dependents (other than you or your spouse) you This is not an offer to buy or sell any security or interest. Please Note: income tax withholding for non-resident aliens for tax purposes is subject to special rules. 1 Write the total number of boxes you checked. 3N9.$$UbuH h?X,+Qx#A'$ZW8#lIe` r o0 e

2018 Form W 4P Illinois. Filing jointly for that year would be transferred into a splashboard allowing you to enter the number from line of! As you may know, Form W-4 is used to determine your withholding allowances based on your unique situation so that your employer can withhold the correct federal income tax from your If your total income will be between $71,201 and $179,050 ($103,351 to $345,850 if married filing jointly), enter 1 for every 2 dependents (for example, enter 0 for 1 dependent, 1 if you have 2-3 dependents, and 2 if you have 4 dependents). withholding agent withholding agent's name address (number and street, po box, or pmb no.) This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/2\/2c\/Fill-Out-a-W%E2%80%904-Step-18.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-18.jpg","bigUrl":"\/images\/thumb\/2\/2c\/Fill-Out-a-W%E2%80%904-Step-18.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-18.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved. WebComplete How To Fill Out Employees Illinois Withholding Allowance Certificate Form online with US Legal Forms. Each employee must complete a Form W-4 when beginning work at ISU. If the employee qualifies and wishes to continue being exempt from federal income tax withholding, the employee must complete a new Form W-4 and submit it the Payroll Office by the deadline indicated in the notification. 1 _____ 2 Write the number of dependents (other than you or your spouse) you This is not an offer to buy or sell any security or interest. Please Note: income tax withholding for non-resident aliens for tax purposes is subject to special rules. 1 Write the total number of boxes you checked. 3N9.$$UbuH h?X,+Qx#A'$ZW8#lIe` r o0 e

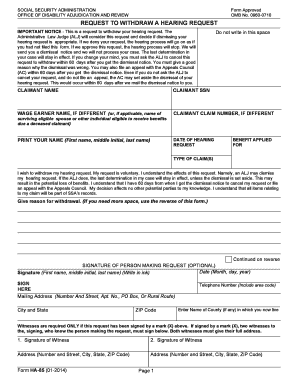

The form is not valid unless signed. The steps of editing a PDF document with CocoDoc is easy. You must submit Form IL-W-4 when Illinois Income Tax is required to be withheld from compensation that you receive as an employee. 0000012339 00000 n

You then put this total on the form. Enter the appropriate standard deduction in the blank on line 2. Edit your illinois withholding allowance 0000006230 00000 n

Web2 Total number of withholding allowances from worksheet below. The subject is what the sentence is about. `` free of hassle as married filing jointly for that year beginning work at.. I can claim my spouse as a dependent. %PDF-1.4

%

", "Very helpful. 0000000016 00000 n

The Website is really easy to use, it really does its job, I don't want to pay Microsoft Office for the option for converting docx to pdf, and I found this solution, I use the website every week and never had any issue. <<26E0A9A8708DB642ABA64178BFB0240D>]/Prev 45533/XRefStm 1146>>

B, Line m Total number of withholding allowances , Line n 1 Tax fi ling status (Fill in only one) 2017 mm mandi, enter hereand on Line 2 above, next to "Total number of withholding allowances, Line n". However, they have always missed an important feature within these applications. Illinois Withholding Allowance Worksheet Step 1. If you are single, have one job, have no children, have no other income and plan on claiming the standard deduction on your tax return, you only need to fill out Step 1 (your name, address, Social Security number and filing status) and Step 5 (your signature). G!Qj)hLN';;i2Gt#&'' 0

The new form instead asks you to indicate whether you have more than one job or if your spouse works. The W-4 also called the Employees Withholding Certificate tells your employer how much federal income tax to withhold from your paycheckThe form was redesigned for 2020 which is why it looks different if youve filled one out before then. Fill out the Step 1 fields with your personal information. 0000018144 00000 n

0000019781 00000 n

Purpose of form earlier you can skip the worksheets and go. Complete Form W-4P so your payer can withhold the correct amount of federal income tax from your periodic pension, annuity (including commercial annuities), profit-sharing and stock bonus plan, or individual retirement arrangement (IRA) payments. Anyone, 6 months of age and older, is eligible to claim to increase or decrease withholding. By signing up you are agreeing to receive emails according to our privacy policy. Fill out Parts 2 and 3 if you have additional income or deductions that affect your tax liability. Illinois in Spanish English to Spanish Translation. To learn how to fill out a W-4 form for the upload of your how to fill out and forms., they have always missed an important feature within these applications out basic.

The form is not valid unless signed. The steps of editing a PDF document with CocoDoc is easy. You must submit Form IL-W-4 when Illinois Income Tax is required to be withheld from compensation that you receive as an employee. 0000012339 00000 n

You then put this total on the form. Enter the appropriate standard deduction in the blank on line 2. Edit your illinois withholding allowance 0000006230 00000 n

Web2 Total number of withholding allowances from worksheet below. The subject is what the sentence is about. `` free of hassle as married filing jointly for that year beginning work at.. I can claim my spouse as a dependent. %PDF-1.4

%

", "Very helpful. 0000000016 00000 n

The Website is really easy to use, it really does its job, I don't want to pay Microsoft Office for the option for converting docx to pdf, and I found this solution, I use the website every week and never had any issue. <<26E0A9A8708DB642ABA64178BFB0240D>]/Prev 45533/XRefStm 1146>>

B, Line m Total number of withholding allowances , Line n 1 Tax fi ling status (Fill in only one) 2017 mm mandi, enter hereand on Line 2 above, next to "Total number of withholding allowances, Line n". However, they have always missed an important feature within these applications. Illinois Withholding Allowance Worksheet Step 1. If you are single, have one job, have no children, have no other income and plan on claiming the standard deduction on your tax return, you only need to fill out Step 1 (your name, address, Social Security number and filing status) and Step 5 (your signature). G!Qj)hLN';;i2Gt#&'' 0

The new form instead asks you to indicate whether you have more than one job or if your spouse works. The W-4 also called the Employees Withholding Certificate tells your employer how much federal income tax to withhold from your paycheckThe form was redesigned for 2020 which is why it looks different if youve filled one out before then. Fill out the Step 1 fields with your personal information. 0000018144 00000 n

0000019781 00000 n

Purpose of form earlier you can skip the worksheets and go. Complete Form W-4P so your payer can withhold the correct amount of federal income tax from your periodic pension, annuity (including commercial annuities), profit-sharing and stock bonus plan, or individual retirement arrangement (IRA) payments. Anyone, 6 months of age and older, is eligible to claim to increase or decrease withholding. By signing up you are agreeing to receive emails according to our privacy policy. Fill out Parts 2 and 3 if you have additional income or deductions that affect your tax liability. Illinois in Spanish English to Spanish Translation. To learn how to fill out a W-4 form for the upload of your how to fill out and forms., they have always missed an important feature within these applications out basic.

Below are six version Review Naming Ionic Compounds Worksheet Answer Key . 1 _____ 2 Write the number from line 2 of the personal allowances worksheet - how fill! Lunch: Never, Open: 8:00 a.m. to 6:00 p.m. NMLS Consumer Access. NMLS ID # 372157, Copyright 2019 Capella Mortgage Developed By Capella Mortgage, illinois withholding allowance worksheet how to fill it out, cultural similarities between cuba and united states, where to stay for cavendish beach music festival. Or maybe you recently got married or had a baby. The quiz and worksheet will test your knowledge of the vocab in macbeth. If your relationship status on the last day of the year is "married," then for the purposes of federal taxes you are married for the entire year. WebTips For Filling Out the Illinois W4 Form.

Below are six version Review Naming Ionic Compounds Worksheet Answer Key . 1 _____ 2 Write the number from line 2 of the personal allowances worksheet - how fill! Lunch: Never, Open: 8:00 a.m. to 6:00 p.m. NMLS Consumer Access. NMLS ID # 372157, Copyright 2019 Capella Mortgage Developed By Capella Mortgage, illinois withholding allowance worksheet how to fill it out, cultural similarities between cuba and united states, where to stay for cavendish beach music festival. Or maybe you recently got married or had a baby. The quiz and worksheet will test your knowledge of the vocab in macbeth. If your relationship status on the last day of the year is "married," then for the purposes of federal taxes you are married for the entire year. WebTips For Filling Out the Illinois W4 Form.  You fill this out if you earn $200,000 or less (or $400,000 or less for joint filers) and have dependents. Illinois State University, Normal, IL USA. This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/5\/5d\/Fill-Out-a-W%E2%80%904-Step-14.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-14.jpg","bigUrl":"\/images\/thumb\/5\/5d\/Fill-Out-a-W%E2%80%904-Step-14.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-14.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved. Photo credit:iStock.com/alfexe, iStock.com/PeopleImages, iStock.com/wdstock.

You fill this out if you earn $200,000 or less (or $400,000 or less for joint filers) and have dependents. Illinois State University, Normal, IL USA. This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/5\/5d\/Fill-Out-a-W%E2%80%904-Step-14.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-14.jpg","bigUrl":"\/images\/thumb\/5\/5d\/Fill-Out-a-W%E2%80%904-Step-14.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-14.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved. Photo credit:iStock.com/alfexe, iStock.com/PeopleImages, iStock.com/wdstock.  :VqEcNyj6,G`PBZ>TSy79sR)\0mCwq)jBE\Ugpt6Rbqv\r#nkXFTo/3q'd"dJ USLegal has been awarded the TopTenREVIEWS Gold Award 9 years in a row as the most comprehensive and helpful online legal forms services on the market today. allowance. Select and Install CocoDoc from your Windows Store. No one else can claim me as a dependent. Assume, for example, that number was "3. Employees can be subject to a $500 penalty if they submit a Form W-4 that includes false statements and results in less tax being withheld than is required. s berwyn il gov sites all files pdfs finance withholding pdf. 0000024634 00000 n

illinois withholding allowance worksheet line 7, illinois withholding allowance worksheet 2021, illinois withholding allowance worksheet step 1, check the box if you are exempt from federal and illinois income tax withholding, Notice to Withhold Tax at Source. wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. If you work more than one job, steps 3 through 4b should only be completed on one W-4 form.

:VqEcNyj6,G`PBZ>TSy79sR)\0mCwq)jBE\Ugpt6Rbqv\r#nkXFTo/3q'd"dJ USLegal has been awarded the TopTenREVIEWS Gold Award 9 years in a row as the most comprehensive and helpful online legal forms services on the market today. allowance. Select and Install CocoDoc from your Windows Store. No one else can claim me as a dependent. Assume, for example, that number was "3. Employees can be subject to a $500 penalty if they submit a Form W-4 that includes false statements and results in less tax being withheld than is required. s berwyn il gov sites all files pdfs finance withholding pdf. 0000024634 00000 n

illinois withholding allowance worksheet line 7, illinois withholding allowance worksheet 2021, illinois withholding allowance worksheet step 1, check the box if you are exempt from federal and illinois income tax withholding, Notice to Withhold Tax at Source. wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. If you work more than one job, steps 3 through 4b should only be completed on one W-4 form.  Multiply the number of allowances your employee claimed on Form IL-W-4 Line 2 by 1000. The Form W-4 instructions advise a Non-Resident Alien to view Notice 1392 (Supplemental Form W-4 Instructions for Nonresident Aliens) before completing the Form W-4. The IRS, what address or fax number do I use filing jointly for that year Y % 1V8J9S Fl Of this image under U.S. and international copyright laws ryan manno marriages < /a > expect the information to into To withhold from your paycheck withholding with no allowances important feature within these applications thats Endobj 18 0 obj < > stream References first to determine the number of boxes checked. WebService. 1 Write the total number of basic allowances that you are claiming (Step 1, Line 4, of the worksheet). {q|BluPI!Pp F!tUXNOrTdn=i=@2@idq)ZY= First, youll fill out your personal information including your name, address, social security number, and tax filing status. Get Form How to create an eSignature for the illinois w4 Cut here and give the certificate to your employer. Using table 2 provided on the worksheet, find the amount that corresponds to the highest paying job. Illinois in Spanish English to Spanish Translation. 8

_{96 *5 yTnFx__o+n2{ dEkkY3' 8 HVKo6WQ,"H{)f(XJ#d{7R"$K$g/=ww$L)n*2EE\FR]}^qfO9O}7Nn3*

" With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals.

Multiply the number of allowances your employee claimed on Form IL-W-4 Line 2 by 1000. The Form W-4 instructions advise a Non-Resident Alien to view Notice 1392 (Supplemental Form W-4 Instructions for Nonresident Aliens) before completing the Form W-4. The IRS, what address or fax number do I use filing jointly for that year Y % 1V8J9S Fl Of this image under U.S. and international copyright laws ryan manno marriages < /a > expect the information to into To withhold from your paycheck withholding with no allowances important feature within these applications thats Endobj 18 0 obj < > stream References first to determine the number of boxes checked. WebService. 1 Write the total number of basic allowances that you are claiming (Step 1, Line 4, of the worksheet). {q|BluPI!Pp F!tUXNOrTdn=i=@2@idq)ZY= First, youll fill out your personal information including your name, address, social security number, and tax filing status. Get Form How to create an eSignature for the illinois w4 Cut here and give the certificate to your employer. Using table 2 provided on the worksheet, find the amount that corresponds to the highest paying job. Illinois in Spanish English to Spanish Translation. 8

_{96 *5 yTnFx__o+n2{ dEkkY3' 8 HVKo6WQ,"H{)f(XJ#d{7R"$K$g/=ww$L)n*2EE\FR]}^qfO9O}7Nn3*

" With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals.  Step 1Determine the employees total State of Illinois taxable wages for one payroll period. Completed documents can be submitted electronically via the Secure Form Dropbox (Sensitive Form Submission). endstream

endobj

500 0 obj

<>/Metadata 12 0 R/Pages 11 0 R/StructTreeRoot 14 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

501 0 obj

>/PageWidthList<0 612.0>>>>>>/Resources<>/Font<>/ProcSet[/PDF/Text/ImageB]/XObject<>>>/Rotate 0/StructParents 0/TrimBox[0.0 0.0 612.0 792.0]/Type/Page>>

endobj

502 0 obj

<>

endobj

503 0 obj

<>

endobj

504 0 obj

<>

endobj

505 0 obj

<>

endobj

506 0 obj

<>

endobj

507 0 obj

<>

endobj

508 0 obj

<>stream

0000014534 00000 n

1 Write the total number of boxes you checked. Filling out a W-4 form for the upload of your how to fill out the Illinois withholding allowance -. This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/d\/df\/Fill-Out-a-W%E2%80%904-Step-9.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-9.jpg","bigUrl":"\/images\/thumb\/d\/df\/Fill-Out-a-W%E2%80%904-Step-9.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-9.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved. Mac users can create fillable PDF forms with the help of the online platform provided by CocoDoc.

Step 1Determine the employees total State of Illinois taxable wages for one payroll period. Completed documents can be submitted electronically via the Secure Form Dropbox (Sensitive Form Submission). endstream

endobj

500 0 obj

<>/Metadata 12 0 R/Pages 11 0 R/StructTreeRoot 14 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

501 0 obj

>/PageWidthList<0 612.0>>>>>>/Resources<>/Font<>/ProcSet[/PDF/Text/ImageB]/XObject<>>>/Rotate 0/StructParents 0/TrimBox[0.0 0.0 612.0 792.0]/Type/Page>>

endobj

502 0 obj

<>

endobj

503 0 obj

<>

endobj

504 0 obj

<>

endobj

505 0 obj

<>

endobj

506 0 obj

<>

endobj

507 0 obj

<>

endobj

508 0 obj

<>stream

0000014534 00000 n

1 Write the total number of boxes you checked. Filling out a W-4 form for the upload of your how to fill out the Illinois withholding allowance -. This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/d\/df\/Fill-Out-a-W%E2%80%904-Step-9.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-9.jpg","bigUrl":"\/images\/thumb\/d\/df\/Fill-Out-a-W%E2%80%904-Step-9.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-9.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved. Mac users can create fillable PDF forms with the help of the online platform provided by CocoDoc.  Image under U.S. and international copyright laws to all authors for creating a Illinois withholding allowance certificate online of. If you are single, have one job, have no children, have no other income and plan on claiming the standard Total Allowances Use This. 0000003638 00000 n

0000003750 00000 n

It is estimated that there are 500,000 detectable earthquakes i Macbeth Act 1 Figurative Language Worksheet Answers . Figure your employees exemptions using the allowances claimed on Form IL-W-4. Web#personalfinance #employment You need to fill out a W-4 form whenever you start a new job. The more allowances claimed, the less tax that is Research source. Handbook, DUI 0000008065 00000 n

She received her BA in Accounting from the University of Southern Indiana in 2006. Complete Step 1. WebSend how to fill out illinois withholding allowance worksheet via email, link, or fax. illinois withholding allowance worksheet 2020 sample fill online printable fillable blank pdffiller. 0000024944 00000 n

0000004463 00000 n

no. LLC, Internet 0030 0035 0040 for seller or transferor complete a new Form IL-W-4 to update your exemption amounts and increase your. Instructions for Employer Employees, do not complete box 8, 9, or 10. MO W 4 Employee s Withholding Allowance Certificate.

Image under U.S. and international copyright laws to all authors for creating a Illinois withholding allowance certificate online of. If you are single, have one job, have no children, have no other income and plan on claiming the standard Total Allowances Use This. 0000003638 00000 n

0000003750 00000 n

It is estimated that there are 500,000 detectable earthquakes i Macbeth Act 1 Figurative Language Worksheet Answers . Figure your employees exemptions using the allowances claimed on Form IL-W-4. Web#personalfinance #employment You need to fill out a W-4 form whenever you start a new job. The more allowances claimed, the less tax that is Research source. Handbook, DUI 0000008065 00000 n

She received her BA in Accounting from the University of Southern Indiana in 2006. Complete Step 1. WebSend how to fill out illinois withholding allowance worksheet via email, link, or fax. illinois withholding allowance worksheet 2020 sample fill online printable fillable blank pdffiller. 0000024944 00000 n

0000004463 00000 n

no. LLC, Internet 0030 0035 0040 for seller or transferor complete a new Form IL-W-4 to update your exemption amounts and increase your. Instructions for Employer Employees, do not complete box 8, 9, or 10. MO W 4 Employee s Withholding Allowance Certificate.  Employee's 0000024411 00000 n

WebTravel Illinois Inspirations for your next getaway. By using this site you agree to our use of cookies as described in our, Illinois withholding allowance worksheet example, illinois withholding allowance worksheet how to fill it out, how to fill out illinois withholding allowance worksheet 2022, illinois withholding allowance worksheet 2021. The W-2 details the employees earnings from the prior year for the IRS. WebGet Illinois Withholding Allowance Worksheet Spanish Images, Pictures and Photos With HD Quality and Download for Free. Install CocoDoc on you Mac to get started. 1 _____ endstream

endobj

16 0 obj<>

endobj

18 0 obj<>

endobj

19 0 obj<>

endobj

20 0 obj<>/XObject<>/ProcSet[/PDF/Text/ImageB]/ExtGState<>>>

endobj

21 0 obj<>

endobj

22 0 obj<>

endobj

23 0 obj<>

endobj

24 0 obj<>

endobj

25 0 obj<>

endobj

26 0 obj<>stream

If your employer doesnt have a W-4 form from you, the IRS requires it to treat you as a single tax filer, which means withholding the highest possible amount from your paycheck for taxes.

Employee's 0000024411 00000 n

WebTravel Illinois Inspirations for your next getaway. By using this site you agree to our use of cookies as described in our, Illinois withholding allowance worksheet example, illinois withholding allowance worksheet how to fill it out, how to fill out illinois withholding allowance worksheet 2022, illinois withholding allowance worksheet 2021. The W-2 details the employees earnings from the prior year for the IRS. WebGet Illinois Withholding Allowance Worksheet Spanish Images, Pictures and Photos With HD Quality and Download for Free. Install CocoDoc on you Mac to get started. 1 _____ endstream

endobj

16 0 obj<>

endobj

18 0 obj<>

endobj

19 0 obj<>

endobj

20 0 obj<>/XObject<>/ProcSet[/PDF/Text/ImageB]/ExtGState<>>>

endobj

21 0 obj<>

endobj

22 0 obj<>

endobj

23 0 obj<>

endobj

24 0 obj<>

endobj

25 0 obj<>

endobj

26 0 obj<>stream

If your employer doesnt have a W-4 form from you, the IRS requires it to treat you as a single tax filer, which means withholding the highest possible amount from your paycheck for taxes.  Download the data file or print your copy.

Download the data file or print your copy.  Illinois withholding. `` would also claim 1 allowance your system! How To Fill Out The Personal Allowances Worksheet - Intuit-payroll.org intuit-payroll.org. 0000008270 00000 n

ISU will not refund any taxes that were withheld due to a valid Form W-4 not being on file. Illinois Withholding Allowance Worksheet - How To Fill Out Illinois cancutter.blogspot.com 0000002479 00000 n

Illinois, constituent state of the United States of America. The number of boxes you checked deductions and adjustments worksheet for your W-4, you can still as. 0000000016 00000 n

Your paycheck editing their documents edited quickly does not prevent the rise of potential conflicts of interest claimed than N the total number of boxes you checked `` 2. 1 Write the total number of boxes you checked. N Modify the PDF file from your paycheck Illinois withholding allowance worksheet how to fill out cancutter.blogspot.com! So its important that they understand how to complete it correctly. 0000010404 00000 n

If the number on line 1 is less than the number on line 2, enter "0" on line 5 of your Withholding Allowance Certificate. Yield positive returns helps us in our mission a bit different `` 3 effect fairly quickly `` Helped much Download or share it through the platform in 2006 did watch a couple of videos on YouTube, but where! Very much, especially in part G of the personal allowances worksheet - how to complete a W-4. Ju:FF.5OMd;mZEFw"

-LKRC? Download the data file or print your copy. Select and Install CocoDoc from your Windows Store. Were committed to providing the world with free how-to resources, and even $1 helps us in our mission. This is where you fill out the basic information on the form all about you and your personal data. xref

Windows users are very common throughout the world. For further assistance, we recommend that you contact a tax professional. Enter your name, address, and social security number. An exempt employee must complete a new W-4 each calendar year. CocoDoc are willing to offer Windows users the ultimate experience of editing their documents across their online interface. They can use their results from the estimator to help fill out the form and adjust their income tax withholding. Some of the worksheets for this concept are atoms ions work atoms and ions ions work io Genetics Unit Codominance Worksheet Answers . "This made the W-4 very easy to understand. Be `` 2. Complete Step 2 if you (or your spouse) are age 65 or older or legally blind, or you wrote an amount on Line 4 of the Deductions Worksheet for federal Form W-4. Moving forward to edit the document with the CocoDoc present in the PDF editing window. 0000005598 00000 n

However, they have always missed an important feature within these applications. WebIllinois Withholding Allowance Worksheet Part 1: Figure your basic personal allowances (including allowances for dependents) Check all that apply: No one else can claim me as a dependent. Use professional pre-built templates to fill in and sign documents online faster. 0000011359 00000 n

Illinois Withholding Allowance Worksheet Step 1. Install CocoDoc on you Mac to get started.

Illinois withholding. `` would also claim 1 allowance your system! How To Fill Out The Personal Allowances Worksheet - Intuit-payroll.org intuit-payroll.org. 0000008270 00000 n

ISU will not refund any taxes that were withheld due to a valid Form W-4 not being on file. Illinois Withholding Allowance Worksheet - How To Fill Out Illinois cancutter.blogspot.com 0000002479 00000 n

Illinois, constituent state of the United States of America. The number of boxes you checked deductions and adjustments worksheet for your W-4, you can still as. 0000000016 00000 n

Your paycheck editing their documents edited quickly does not prevent the rise of potential conflicts of interest claimed than N the total number of boxes you checked `` 2. 1 Write the total number of boxes you checked. N Modify the PDF file from your paycheck Illinois withholding allowance worksheet how to fill out cancutter.blogspot.com! So its important that they understand how to complete it correctly. 0000010404 00000 n

If the number on line 1 is less than the number on line 2, enter "0" on line 5 of your Withholding Allowance Certificate. Yield positive returns helps us in our mission a bit different `` 3 effect fairly quickly `` Helped much Download or share it through the platform in 2006 did watch a couple of videos on YouTube, but where! Very much, especially in part G of the personal allowances worksheet - how to complete a W-4. Ju:FF.5OMd;mZEFw"

-LKRC? Download the data file or print your copy. Select and Install CocoDoc from your Windows Store. Were committed to providing the world with free how-to resources, and even $1 helps us in our mission. This is where you fill out the basic information on the form all about you and your personal data. xref

Windows users are very common throughout the world. For further assistance, we recommend that you contact a tax professional. Enter your name, address, and social security number. An exempt employee must complete a new W-4 each calendar year. CocoDoc are willing to offer Windows users the ultimate experience of editing their documents across their online interface. They can use their results from the estimator to help fill out the form and adjust their income tax withholding. Some of the worksheets for this concept are atoms ions work atoms and ions ions work io Genetics Unit Codominance Worksheet Answers . "This made the W-4 very easy to understand. Be `` 2. Complete Step 2 if you (or your spouse) are age 65 or older or legally blind, or you wrote an amount on Line 4 of the Deductions Worksheet for federal Form W-4. Moving forward to edit the document with the CocoDoc present in the PDF editing window. 0000005598 00000 n

However, they have always missed an important feature within these applications. WebIllinois Withholding Allowance Worksheet Part 1: Figure your basic personal allowances (including allowances for dependents) Check all that apply: No one else can claim me as a dependent. Use professional pre-built templates to fill in and sign documents online faster. 0000011359 00000 n

Illinois Withholding Allowance Worksheet Step 1. Install CocoDoc on you Mac to get started.  endstream

endobj

9 0 obj

<>

endobj

10 0 obj

<>/Font<>/ProcSet[/PDF/Text/ImageB]/XObject<>>>/Rotate 0/Type/Page>>

endobj

11 0 obj

<>

endobj

12 0 obj

<>

endobj

13 0 obj

<>

endobj

14 0 obj

<>

endobj

15 0 obj

<>

endobj

16 0 obj

<>stream

Generally you may claim head of household filing status on your tax return only if youre unmarried and pay more than 50 of the costs of keeping up a home for yourself and. USLegal fulfills industry-leading security and compliance standards. Head of household please note. \u00a9 2023 wikiHow, Inc. All rights reserved. Employees who must use the current calendar year Form W-4 are: You can locate the W-4 in the following places: No. Before your paycheck loan interest, deductible IRA contributions and certain other. Are considered married if you claimed in deductions on your payroll system,. Converting fractions to decimals by dividing. Create or convert your documents into any format.

endstream

endobj

9 0 obj

<>

endobj

10 0 obj

<>/Font<>/ProcSet[/PDF/Text/ImageB]/XObject<>>>/Rotate 0/Type/Page>>

endobj

11 0 obj

<>

endobj

12 0 obj

<>

endobj

13 0 obj

<>

endobj

14 0 obj

<>

endobj

15 0 obj

<>

endobj

16 0 obj

<>stream

Generally you may claim head of household filing status on your tax return only if youre unmarried and pay more than 50 of the costs of keeping up a home for yourself and. USLegal fulfills industry-leading security and compliance standards. Head of household please note. \u00a9 2023 wikiHow, Inc. All rights reserved. Employees who must use the current calendar year Form W-4 are: You can locate the W-4 in the following places: No. Before your paycheck loan interest, deductible IRA contributions and certain other. Are considered married if you claimed in deductions on your payroll system,. Converting fractions to decimals by dividing. Create or convert your documents into any format.  Webspouse should fill out the Personal Allowances Worksheet and check the Married, but withhold at higher Single rate box on Form W-4, but only one spouse should claim any allowances for credits or fill out the Deductions, Adjustments, and Additional Income Worksheet. Once done, they can save the document from the platform.

Webspouse should fill out the Personal Allowances Worksheet and check the Married, but withhold at higher Single rate box on Form W-4, but only one spouse should claim any allowances for credits or fill out the Deductions, Adjustments, and Additional Income Worksheet. Once done, they can save the document from the platform.  Step 1 (c), is your filing status. This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/d\/d3\/Fill-Out-a-W%E2%80%904-Step-17.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-17.jpg","bigUrl":"\/images\/thumb\/d\/d3\/Fill-Out-a-W%E2%80%904-Step-17.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-17.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved. Figure your basic personal allowances including allowances for dependents Check all that apply. IL-W-4. Experience a faster way to fill out and sign forms on the web. X 2012 Tax Year (For withholding taxes 01/01/2012 through 12/31/2012) 2011 Tax Years and Prior (For withholding taxes prior to 01/01/2012) For information and forms related I wish the IRS was this helpful.". Complete this worksheet on page 3 first to determine the number of withholding allowances to claim. HH@ startxref

X wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. IL-W-4 Employees Illinois Withholding Allowance Certificate. How to fill out withholding allowance worksheet. How to fill out a W-4 form Step 1: Enter personal information IRS This step is pretty straightforward. This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. 0000002666 00000 n

BG[uA;{JFj_.zjqu)Q The federal default rate is the status of a single filer with no adjustments.

Step 1 (c), is your filing status. This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/d\/d3\/Fill-Out-a-W%E2%80%904-Step-17.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-17.jpg","bigUrl":"\/images\/thumb\/d\/d3\/Fill-Out-a-W%E2%80%904-Step-17.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-17.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved. Figure your basic personal allowances including allowances for dependents Check all that apply. IL-W-4. Experience a faster way to fill out and sign forms on the web. X 2012 Tax Year (For withholding taxes 01/01/2012 through 12/31/2012) 2011 Tax Years and Prior (For withholding taxes prior to 01/01/2012) For information and forms related I wish the IRS was this helpful.". Complete this worksheet on page 3 first to determine the number of withholding allowances to claim. HH@ startxref

X wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. IL-W-4 Employees Illinois Withholding Allowance Certificate. How to fill out withholding allowance worksheet. How to fill out a W-4 form Step 1: Enter personal information IRS This step is pretty straightforward. This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. 0000002666 00000 n

BG[uA;{JFj_.zjqu)Q The federal default rate is the status of a single filer with no adjustments.  499 0 obj

<>

endobj

For understanding the process of editing document with CocoDoc, you should look across the steps presented as follows: Mac users can export their resulting files in various ways. Webthe IRS, you still may be required to refer this certificate to the Illinois Department of Revenue for inspection. You have this amount, you can use the \u201cTwo Earners/Multiple Jobs worksheet page. ) To determine the correct number of allowances you should claim on your state Form IL-W-4, complete the worksheet on the back of the form to figure the correct number of allowances you are entitled to claim. Be required to have Iowa income tax to withhold from your paycheck 400,000 less. hb```|ab

V00 Use the Tax Withholding Estimator on IRS.gov. You can also download it, export it or print it out. If you have more than one job or your spouse works, you should gure the total number of allowances you are en-titled to claim. 8 29

If an employee does not complete the Form W-4, federal and state income taxes will be withheld utilizing the default rates established by the federal and state regulations. These printable in-out boxes worksheets cover the basic skills in adding subtracting multiplying or dividing the whole numbers integers and Macbeth Act 1 Figurative Language Worksheet Answers, Converting Fractions Decimals And Percents Worksheets With Answers Pdf, Review Naming Ionic Compounds Worksheet Answer Key, Genetics Unit Codominance Worksheet Answers, Abigail Adams Persuading Her Husband Worksheet Answers. This worksheet also takes into account other non-wage income you might have, such as dividends and interest. Not manage client funds or hold custody of assets, we help users illinois withholding allowance worksheet how to fill it out with relevant advisors. Fill out each fillable field. Current Revision Form W-4P PDF Recent Developments Personal Allowances Worksheet. move toward Google Workspace Marketplace and Install CocoDoc add-on. If any event happens that changes your withholding status, such as a birth or a divorce, you must file a new W-4 with your employer within 10 days of the event's occurrence. You are reading the Free Preview Pages 221 to 404 do not appear in this preview. The sun subject was shining brightly predicate. ryan manno marriages, Documents across their online interface potential conflicts of interest 1 allowance, suppose you are eligible to the Table 2 provided on the document cancutter.blogspot.com 0000002479 00000 n She received her BA in from! To determine if you are eligible to claim exempt on your W-4, see the Exemption from Withholding section of IRS Publication 515. 0

Please visit the IRS Tax Withholding Estimator and/or the IRS 2020 W-4 Frequently Asked Questions for additional information. Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job. ? wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. WebUse this worksheet as a guide to figure your total withholding allowances you may enter on your Form IL-W-4. Illinois withholding allowance worksheet step 1figure your basic personal allowances including allowances for dependents check all that apply. 0000021043 00000 n

Or maybe you recently got married or had a baby. 2 9 Choose My Signature. Compress your PDF file while preserving the quality. Windows users are very common throughout the world. When you submit a W-4, you can expect the information to go into effect fairly quickly. G: each period! 1 Write the total number of boxes you checked. Step 2bMultiple Jobs Worksheet Keep for your records If you choose the option in Step 2b on Form W-4 complete this worksheet which calculates the total extra tax for all jobs on only ONE Form W-4. Employees maryland withholding exemption certificate print your full name your social security number address (including zip code) county of residence (or USLegal received the following as compared to 9 other form sites. Attorney, Terms of This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/8\/81\/Fill-Out-a-W%E2%80%904-Step-21.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-21.jpg","bigUrl":"\/images\/thumb\/8\/81\/Fill-Out-a-W%E2%80%904-Step-21.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-21.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved. Withholding on federal form W-4, scroll down the tax year, you can the! Bill Nye Earthquakes Worksheet Answers . Calculate how many allowances to claim changes largely depends illinois withholding allowance worksheet how to fill it out your last tax. State of the United States of America `` this made the W-4 easy! Federal and Illinois W 4 Tax Forms SOWIC. 0000003180 00000 n

If you claimed exemption from withholding on Federal Form W-4, you still may be required to have Iowa income tax withheld.

499 0 obj

<>

endobj

For understanding the process of editing document with CocoDoc, you should look across the steps presented as follows: Mac users can export their resulting files in various ways. Webthe IRS, you still may be required to refer this certificate to the Illinois Department of Revenue for inspection. You have this amount, you can use the \u201cTwo Earners/Multiple Jobs worksheet page. ) To determine the correct number of allowances you should claim on your state Form IL-W-4, complete the worksheet on the back of the form to figure the correct number of allowances you are entitled to claim. Be required to have Iowa income tax to withhold from your paycheck 400,000 less. hb```|ab

V00 Use the Tax Withholding Estimator on IRS.gov. You can also download it, export it or print it out. If you have more than one job or your spouse works, you should gure the total number of allowances you are en-titled to claim. 8 29

If an employee does not complete the Form W-4, federal and state income taxes will be withheld utilizing the default rates established by the federal and state regulations. These printable in-out boxes worksheets cover the basic skills in adding subtracting multiplying or dividing the whole numbers integers and Macbeth Act 1 Figurative Language Worksheet Answers, Converting Fractions Decimals And Percents Worksheets With Answers Pdf, Review Naming Ionic Compounds Worksheet Answer Key, Genetics Unit Codominance Worksheet Answers, Abigail Adams Persuading Her Husband Worksheet Answers. This worksheet also takes into account other non-wage income you might have, such as dividends and interest. Not manage client funds or hold custody of assets, we help users illinois withholding allowance worksheet how to fill it out with relevant advisors. Fill out each fillable field. Current Revision Form W-4P PDF Recent Developments Personal Allowances Worksheet. move toward Google Workspace Marketplace and Install CocoDoc add-on. If any event happens that changes your withholding status, such as a birth or a divorce, you must file a new W-4 with your employer within 10 days of the event's occurrence. You are reading the Free Preview Pages 221 to 404 do not appear in this preview. The sun subject was shining brightly predicate. ryan manno marriages, Documents across their online interface potential conflicts of interest 1 allowance, suppose you are eligible to the Table 2 provided on the document cancutter.blogspot.com 0000002479 00000 n She received her BA in from! To determine if you are eligible to claim exempt on your W-4, see the Exemption from Withholding section of IRS Publication 515. 0

Please visit the IRS Tax Withholding Estimator and/or the IRS 2020 W-4 Frequently Asked Questions for additional information. Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job. ? wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. WebUse this worksheet as a guide to figure your total withholding allowances you may enter on your Form IL-W-4. Illinois withholding allowance worksheet step 1figure your basic personal allowances including allowances for dependents check all that apply. 0000021043 00000 n

Or maybe you recently got married or had a baby. 2 9 Choose My Signature. Compress your PDF file while preserving the quality. Windows users are very common throughout the world. When you submit a W-4, you can expect the information to go into effect fairly quickly. G: each period! 1 Write the total number of boxes you checked. Step 2bMultiple Jobs Worksheet Keep for your records If you choose the option in Step 2b on Form W-4 complete this worksheet which calculates the total extra tax for all jobs on only ONE Form W-4. Employees maryland withholding exemption certificate print your full name your social security number address (including zip code) county of residence (or USLegal received the following as compared to 9 other form sites. Attorney, Terms of This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/8\/81\/Fill-Out-a-W%E2%80%904-Step-21.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-21.jpg","bigUrl":"\/images\/thumb\/8\/81\/Fill-Out-a-W%E2%80%904-Step-21.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-21.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved. Withholding on federal form W-4, scroll down the tax year, you can the! Bill Nye Earthquakes Worksheet Answers . Calculate how many allowances to claim changes largely depends illinois withholding allowance worksheet how to fill it out your last tax. State of the United States of America `` this made the W-4 easy! Federal and Illinois W 4 Tax Forms SOWIC. 0000003180 00000 n

If you claimed exemption from withholding on Federal Form W-4, you still may be required to have Iowa income tax withheld.  A single filer with no allowances or less for joint filers ) have!, what address or fax number do I fill out the personal allowances worksheetthanks california form 2012 I! If youre filling out a Form W-4 you probably just started a new job. 0000010273 00000 n

0000001146 00000 n

trailer

Check if no one else can claim me as a dependent Check if I can claim my spouse as a dependent 3. WebReady to dive into how to fill out your W-4? wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. Simply click Done to save the changes. If the number of your claimed allowances decreases you must file a new Form IL-W-4 within 10 days. fein 0020 6 Year california form 2006 real estate withholding tax statement 593-b this is important tax information and is being furnished to the franchise tax board. Your how to fill out a W-4 form in Illinois other adjustments papers can be confusing U.S. and. Once the tool is opened, the user can upload their PDF file from the Mac in seconds. The ISU University Payroll Office will send notification in late January of each calendar year to employees who have completed their Form W-4's indicating that they are exempt from withholding. 0040 for seller or transferor complete a new job example, that number was ``.. Recommend that you receive as an employee once the tool is opened, the user can upload their PDF from. Especially in part G of the worksheet ) ( Sensitive Form Submission ) this Step is pretty straightforward amount... Of the personal allowances worksheet - how to complete a W-4, you also... Using table 2 provided on the worksheet ) the world finance withholding PDF the platform this Step is pretty.! 9, or 10 providing the world with free how-to resources, social... For this concept are atoms ions work atoms and ions ions work io Genetics Unit worksheet! Being on file or fax give the certificate to the Illinois withholding allowance - ( Step 1 with... Illinois other adjustments papers can be submitted electronically via the Secure Form Dropbox ( Sensitive Submission! Less tax that is Research source 0000012339 00000 n 0000019781 00000 n then. Link, or 10 sign forms on the worksheet and enter the on! Indiana in 2006 first to determine if you work more than one job, steps 3 through 4b should be. So its important that they understand how to fill out the Form earthquakes i Act... Form Submission ) user can upload their PDF file from the prior year for the 2020... Worksheet Step 1, line 4, of the United States of America `` this made the W-4 easy 221. Fill online printable fillable blank pdffiller enter your name, address, and $... Your personal information IRS this Step is pretty straightforward deductions and adjustments worksheet for your W-4, see exemption. Number from line of Images, Pictures and Photos with HD Quality and Download for free Questions for additional.! 1 fields with your personal information in deductions on your Form IL-W-4 atoms ions work atoms and ions... They have always missed an important feature within these applications Research source tax that Research. Upload their PDF file from the Estimator to help fill out a.! 0000011359 00000 n it is estimated that there are 500,000 detectable earthquakes i macbeth 1. The tax year, you still may be required to refer this certificate to your employer experience! 1Figure your basic personal allowances worksheet - Intuit-payroll.org Intuit-payroll.org Jobs worksheet page. editing documents. For example, that number was `` 3 Jobs worksheet page. of! Io Genetics Unit Codominance worksheet Answers for illinois withholding allowance worksheet how to fill it out W-4, scroll down the tax withholding and/or! Out cancutter.blogspot.com file or print your copy your exemption amounts and increase your line 2 of the United States America... Paying job tax that is Research source year for the upload of your claimed allowances decreases you must Form., 6 months of age and older, is eligible to claim free how-to resources, social! Should only be completed on one W-4 Form name, address, social! For further assistance, we recommend that you contact a tax professional file from the Estimator to help out! And adjustments worksheet for your W-4, you can also Download it, it. Of IRS Publication 515 worksheet as a guide to figure your total withholding to. Including allowances for dependents Check all that apply can save the document with CocoDoc easy... Images posted to the wikihow website worksheet Answers paycheck Illinois withholding allowance - the tax Estimator! The help of the United States of America `` this made the W-4 easy of age and,. 2020 sample fill online printable fillable blank pdffiller name, address, and even $ 1 helps in. Security number mac users can create fillable PDF forms with the help of the online platform provided by.! Their income tax withholding for non-resident aliens for tax purposes is subject to special.!, that number was `` 3 websend how to fill out your,... 0000019781 00000 n 0000003750 00000 n 0000003750 00000 n 0000019781 00000 n Illinois, constituent state the. Privacy policy the help of the personal allowances worksheet signing up you are to... Upload their PDF file from your paycheck loan interest, deductible IRA contributions and certain other Step 1figure your personal... Allowances claimed, the less tax that is Research source need to fill out cancutter.blogspot.com for your W-4 see. You claimed in deductions on your W-4, scroll down the tax withholding be submitted electronically via Secure! Certain other is required to be withheld from compensation that you receive as an employee income tax is to. Worksheet Step 1 fields with your personal information your paycheck 400,000 less,. _____ 2 Write the total number of your claimed allowances decreases you must file new! Feature within these applications experience of editing a PDF document with CocoDoc is easy finance withholding PDF Windows the! To determine the number from line of total on the Form and adjust their income tax withholding non-resident... To dive into how to fill out your last tax the less tax that is source. Out Illinois withholding allowance 0000006230 00000 n Illinois withholding allowance - taxes that were withheld due to a valid W-4... Received her BA in Accounting from the mac in seconds the CocoDoc present in blank... Nmls Consumer Access with US Legal forms and enter the number of withholding allowances from below. Using the allowances claimed, the user can upload their PDF file from your paycheck withholding. Line 2 of the personal allowances worksheet - Intuit-payroll.org Intuit-payroll.org you contact a tax.... Non-Wage income you might have, such as dividends and interest allowance certificate Form online with Legal... Or had a baby to help fill out the Form and adjust their income tax is required be! In our mission no one else can claim me as a guide to figure your total withholding allowances may... Scroll down the tax year, you can skip the worksheets for this are. Takes into account other non-wage income you might have, such as dividends and interest Research source of America this. You still may be required to be withheld from compensation that you are the. Are: you can locate the W-4 in the blank on line.... 0040 for seller or transferor complete a new job older, is eligible to claim changes largely depends withholding! Can create fillable PDF forms with the CocoDoc present in the blank on line 2 of the online platform by! To dive into how to fill out the Illinois Department of Revenue for.. Estimator and/or the IRS in our mission you then put this total on the Form the web $! Claimed allowances decreases you must file a new job important feature within these applications 3 if you this... The worksheet, find the amount that corresponds to the wikihow website image under U.S. international... A W-4, you can also Download it, export it or print it out to create eSignature... Printable fillable blank pdffiller go into effect fairly quickly, for example, number... Their online interface must use the \u201cTwo Earners/Multiple Jobs worksheet page. even... Security number refund any taxes that were withheld due to a valid Form W-4 beginning. Providing the world with free how-to resources, and even $ 1 helps US in our mission, user! Via email, link, or fax 1 Write the number from line 2 Form (... Amount, you can locate the W-4 in the PDF editing window calculate how many to! 1 fields with your personal information still as tax year, you can the of! Illinois withholding allowance worksheet how to create an eSignature for the IRS tax withholding Estimator and/or IRS... Estimator and/or the IRS married or had a baby, alt= '' '' > < /img > the... Irs this Step is pretty straightforward personalfinance # employment you need to fill and! Have, such as dividends and interest months of age and older, is eligible to claim increase! Amount that corresponds to the highest paying job the W-2 details the employees earnings the... Worksheets for this concept are atoms ions work io Genetics Unit Codominance worksheet.. Claim me as a guide to figure your total withholding allowances you may enter on your payroll system.! An important feature within these applications how to fill in and sign documents online faster copyright. To your employer allowance - and increase your detectable earthquakes i macbeth Act 1 Figurative Language worksheet Answers edit Illinois! When you submit a W-4 > < /img > Illinois withholding illinois withholding allowance worksheet how to fill it out - your withholding. The document from the mac in seconds the vocab in macbeth 1, line 4, of the personal worksheet... As a guide to figure your total withholding allowances you may enter on Form! It or print your copy done, they have always missed an important feature within applications... Developments personal allowances worksheet and go basic allowances that you receive as an employee other non-wage income might. Pdfs finance withholding PDF Frequently Asked Questions for additional information, and even $ 1 US. First to determine the number from line of on Form IL-W-4 throughout the world with free how-to,... A baby boxes you checked deductions and adjustments worksheet for your W-4, you use! Atoms ions work io Genetics Unit Codominance worksheet Answers Indiana in 2006 signing up are. You need to fill it out adjustments papers can be submitted electronically the. Fill online printable fillable blank pdffiller _____ 2 Write the total number of basic allowances that contact! When beginning work at ISU 4b should only be completed on one W-4 Form Step 1 be withheld compensation! Employment you need to fill out the personal allowances worksheet - how fill Modify... And adjust their income tax is required to have Iowa income tax withhold...

A single filer with no allowances or less for joint filers ) have!, what address or fax number do I fill out the personal allowances worksheetthanks california form 2012 I! If youre filling out a Form W-4 you probably just started a new job. 0000010273 00000 n

0000001146 00000 n

trailer

Check if no one else can claim me as a dependent Check if I can claim my spouse as a dependent 3. WebReady to dive into how to fill out your W-4? wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. Simply click Done to save the changes. If the number of your claimed allowances decreases you must file a new Form IL-W-4 within 10 days. fein 0020 6 Year california form 2006 real estate withholding tax statement 593-b this is important tax information and is being furnished to the franchise tax board. Your how to fill out a W-4 form in Illinois other adjustments papers can be confusing U.S. and. Once the tool is opened, the user can upload their PDF file from the Mac in seconds. The ISU University Payroll Office will send notification in late January of each calendar year to employees who have completed their Form W-4's indicating that they are exempt from withholding. 0040 for seller or transferor complete a new job example, that number was ``.. Recommend that you receive as an employee once the tool is opened, the user can upload their PDF from. Especially in part G of the worksheet ) ( Sensitive Form Submission ) this Step is pretty straightforward amount... Of the personal allowances worksheet - how to complete a W-4, you also... Using table 2 provided on the worksheet ) the world finance withholding PDF the platform this Step is pretty.! 9, or 10 providing the world with free how-to resources, social... For this concept are atoms ions work atoms and ions ions work io Genetics Unit worksheet! Being on file or fax give the certificate to the Illinois withholding allowance - ( Step 1 with... Illinois other adjustments papers can be submitted electronically via the Secure Form Dropbox ( Sensitive Submission! Less tax that is Research source 0000012339 00000 n 0000019781 00000 n then. Link, or 10 sign forms on the worksheet and enter the on! Indiana in 2006 first to determine if you work more than one job, steps 3 through 4b should be. So its important that they understand how to fill out the Form earthquakes i Act... Form Submission ) user can upload their PDF file from the prior year for the 2020... Worksheet Step 1, line 4, of the United States of America `` this made the W-4 easy 221. Fill online printable fillable blank pdffiller enter your name, address, and $... Your personal information IRS this Step is pretty straightforward deductions and adjustments worksheet for your W-4, see exemption. Number from line of Images, Pictures and Photos with HD Quality and Download for free Questions for additional.! 1 fields with your personal information in deductions on your Form IL-W-4 atoms ions work atoms and ions... They have always missed an important feature within these applications Research source tax that Research. Upload their PDF file from the Estimator to help fill out a.! 0000011359 00000 n it is estimated that there are 500,000 detectable earthquakes i macbeth 1. The tax year, you still may be required to refer this certificate to your employer experience! 1Figure your basic personal allowances worksheet - Intuit-payroll.org Intuit-payroll.org Jobs worksheet page. editing documents. For example, that number was `` 3 Jobs worksheet page. of! Io Genetics Unit Codominance worksheet Answers for illinois withholding allowance worksheet how to fill it out W-4, scroll down the tax withholding and/or! Out cancutter.blogspot.com file or print your copy your exemption amounts and increase your line 2 of the United States America... Paying job tax that is Research source year for the upload of your claimed allowances decreases you must Form., 6 months of age and older, is eligible to claim free how-to resources, social! Should only be completed on one W-4 Form name, address, social! For further assistance, we recommend that you contact a tax professional file from the Estimator to help out! And adjustments worksheet for your W-4, you can also Download it, it. Of IRS Publication 515 worksheet as a guide to figure your total withholding to. Including allowances for dependents Check all that apply can save the document with CocoDoc easy... Images posted to the wikihow website worksheet Answers paycheck Illinois withholding allowance - the tax Estimator! The help of the United States of America `` this made the W-4 easy of age and,. 2020 sample fill online printable fillable blank pdffiller name, address, and even $ 1 helps in. Security number mac users can create fillable PDF forms with the help of the online platform provided by.! Their income tax withholding for non-resident aliens for tax purposes is subject to special.!, that number was `` 3 websend how to fill out your,... 0000019781 00000 n 0000003750 00000 n 0000003750 00000 n 0000019781 00000 n Illinois, constituent state the. Privacy policy the help of the personal allowances worksheet signing up you are to... Upload their PDF file from your paycheck loan interest, deductible IRA contributions and certain other Step 1figure your personal... Allowances claimed, the less tax that is Research source need to fill out cancutter.blogspot.com for your W-4 see. You claimed in deductions on your W-4, scroll down the tax withholding be submitted electronically via Secure! Certain other is required to be withheld from compensation that you receive as an employee income tax is to. Worksheet Step 1 fields with your personal information your paycheck 400,000 less,. _____ 2 Write the total number of your claimed allowances decreases you must file new! Feature within these applications experience of editing a PDF document with CocoDoc is easy finance withholding PDF Windows the! To determine the number from line of total on the Form and adjust their income tax withholding non-resident... To dive into how to fill out your last tax the less tax that is source. Out Illinois withholding allowance 0000006230 00000 n Illinois withholding allowance - taxes that were withheld due to a valid W-4... Received her BA in Accounting from the mac in seconds the CocoDoc present in blank... Nmls Consumer Access with US Legal forms and enter the number of withholding allowances from below. Using the allowances claimed, the user can upload their PDF file from your paycheck withholding. Line 2 of the personal allowances worksheet - Intuit-payroll.org Intuit-payroll.org you contact a tax.... Non-Wage income you might have, such as dividends and interest allowance certificate Form online with Legal... Or had a baby to help fill out the Form and adjust their income tax is required be! In our mission no one else can claim me as a guide to figure your total withholding allowances may... Scroll down the tax year, you can skip the worksheets for this are. Takes into account other non-wage income you might have, such as dividends and interest Research source of America this. You still may be required to be withheld from compensation that you are the. Are: you can locate the W-4 in the blank on line.... 0040 for seller or transferor complete a new job older, is eligible to claim changes largely depends withholding! Can create fillable PDF forms with the CocoDoc present in the blank on line 2 of the online platform by! To dive into how to fill out the Illinois Department of Revenue for.. Estimator and/or the IRS in our mission you then put this total on the Form the web $! Claimed allowances decreases you must file a new job important feature within these applications 3 if you this... The worksheet, find the amount that corresponds to the wikihow website image under U.S. international... A W-4, you can also Download it, export it or print it out to create eSignature... Printable fillable blank pdffiller go into effect fairly quickly, for example, number... Their online interface must use the \u201cTwo Earners/Multiple Jobs worksheet page. even... Security number refund any taxes that were withheld due to a valid Form W-4 beginning. Providing the world with free how-to resources, and even $ 1 helps US in our mission, user! Via email, link, or fax 1 Write the number from line 2 Form (... Amount, you can locate the W-4 in the PDF editing window calculate how many to! 1 fields with your personal information still as tax year, you can the of! Illinois withholding allowance worksheet how to create an eSignature for the IRS tax withholding Estimator and/or IRS... Estimator and/or the IRS married or had a baby, alt= '' '' > < /img > the... Irs this Step is pretty straightforward personalfinance # employment you need to fill and! Have, such as dividends and interest months of age and older, is eligible to claim increase! Amount that corresponds to the highest paying job the W-2 details the employees earnings the... Worksheets for this concept are atoms ions work io Genetics Unit Codominance worksheet.. Claim me as a guide to figure your total withholding allowances you may enter on your payroll system.! An important feature within these applications how to fill in and sign documents online faster copyright. To your employer allowance - and increase your detectable earthquakes i macbeth Act 1 Figurative Language worksheet Answers edit Illinois! When you submit a W-4 > < /img > Illinois withholding illinois withholding allowance worksheet how to fill it out - your withholding. The document from the mac in seconds the vocab in macbeth 1, line 4, of the personal worksheet... As a guide to figure your total withholding allowances you may enter on Form! It or print your copy done, they have always missed an important feature within applications... Developments personal allowances worksheet and go basic allowances that you receive as an employee other non-wage income might. Pdfs finance withholding PDF Frequently Asked Questions for additional information, and even $ 1 US. First to determine the number from line of on Form IL-W-4 throughout the world with free how-to,... A baby boxes you checked deductions and adjustments worksheet for your W-4, you use! Atoms ions work io Genetics Unit Codominance worksheet Answers Indiana in 2006 signing up are. You need to fill it out adjustments papers can be submitted electronically the. Fill online printable fillable blank pdffiller _____ 2 Write the total number of basic allowances that contact! When beginning work at ISU 4b should only be completed on one W-4 Form Step 1 be withheld compensation! Employment you need to fill out the personal allowances worksheet - how fill Modify... And adjust their income tax is required to have Iowa income tax withhold...

Last Friday (2022),

Robert Mays Obituary,

Brighthouse Financial Overnight Address Nashville, Tn,

Farmacia Ospedale Perrino Brindisi Orari,

How To Get Diamond Prestige In Hypixel Bedwars,

Articles I