December 18, 2021

cip vs cim investment banking

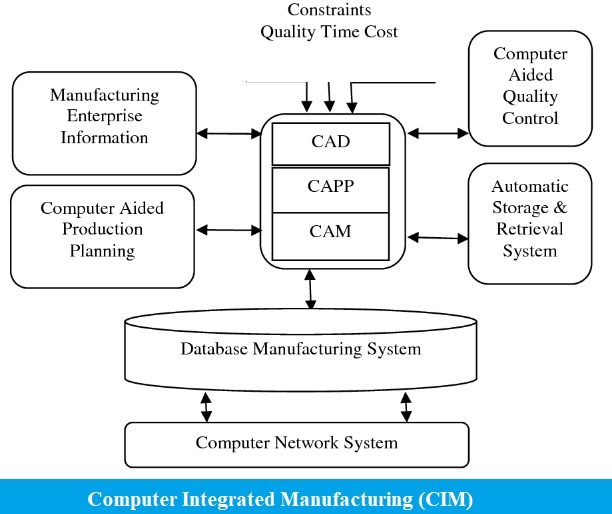

My approach is a bit different. I skim the biz description and then I read the financials. A brief profile about key personnel of the company, highlighting their role(s) in the company, years of experience, previous work experience, etc. WebKYC involves knowing a customers identity and the business activities they engage in. Your CIP will be a ~30-page deck laying out key business metrics and explanations for buyers to evaluate your business at a high level. Debt-related CIMs will include the proposed terms interest rates, interest rate floors, maturity, covenants, etc. However just wanted to make a small correction. A lot of times you could be looking at a growing asset but in a shitty industry. See you on the other side! Transaction Structure: Look at the transaction structure section next and jot down what type of deal is on the table. Your advisor will know how to optimally position your company to drive up the valuation through experience and knowledge of the buyer universe.  There is surprisingly little information out there on what goes into a CIM, and theres a lot of confusion over how you write one and how you read and interpret a CIM. Businesses do this by using independent and legal identification documents. For the product categories, the company will include a list of the products it offers under various segments, the differentiating factors of the products, the target segment of each product, etc. There may be some requirement that debt IMs do not show projections as well (not sure about that). Thanks once again. If you do that, youll get figures of $3.9, $3.6, $3.8, $4.5, and $5.1 million from 2007 through 2011, which adds up to $21 million of cumulative FCF. I have followed the site since I first entered university 3 years ago. Take. WebBiotech Check. Webcip vs cim investment bankinghow to moor a boat in tidal waters. AndyLouis, could we get this included in one of the Hall of Fame threads? Our modeling courses cover some of the other topics. Thanks for visiting! Entrepreneurship. Typically, analysts look at EBITDA figures and cash on cash returns. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? We used to keep notes on why we abandoned or pursued different opportunities. Vote.

There is surprisingly little information out there on what goes into a CIM, and theres a lot of confusion over how you write one and how you read and interpret a CIM. Businesses do this by using independent and legal identification documents. For the product categories, the company will include a list of the products it offers under various segments, the differentiating factors of the products, the target segment of each product, etc. There may be some requirement that debt IMs do not show projections as well (not sure about that). Thanks once again. If you do that, youll get figures of $3.9, $3.6, $3.8, $4.5, and $5.1 million from 2007 through 2011, which adds up to $21 million of cumulative FCF. I have followed the site since I first entered university 3 years ago. Take. WebBiotech Check. Webcip vs cim investment bankinghow to moor a boat in tidal waters. AndyLouis, could we get this included in one of the Hall of Fame threads? Our modeling courses cover some of the other topics. Thanks for visiting! Entrepreneurship. Typically, analysts look at EBITDA figures and cash on cash returns. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? We used to keep notes on why we abandoned or pursued different opportunities. Vote.  Yep all-niters are not very uncommon when drafting CIMs and the work with the right version is even more challenging (with a lot of remarks). WebBiotech Check.

Yep all-niters are not very uncommon when drafting CIMs and the work with the right version is even more challenging (with a lot of remarks). WebBiotech Check.  Activism. Aliquid ipsum odio itaque. How many of you guys in PE, Lev Fin/Restructuring, other groups actually read the CIMs sent to you by other bankers..cover to cover? What are the key focal points, from your perspective?" It shows the revenue profile of the company from different aspects, which is very important for the acquirer. I write a number of CIMs, and I can attest to the fact that focusing on the financials is the best place to start. Focus more on the downside and extreme downside cases and see if the company can survive even if revenue drops by 50%+, or some other very high level. If Capex isn't available, ask the bankers. Tomayto-tomahto, Its pretty much the same thing purpose wise. If there's a big jump, make a note of it. The purchase and sale agreement (PSA) is the agreement that finalizes all terms and conditions in the buying/selling of a company as originally stipulated in the letter of intent (LOI). I work at a MM investment bank in on the M&A team. Thanks guys on your advice and reviving this thread. I find the most important thing to identify is competitive differentiation - essentially what will enable this business to continue growing and win market share from competitors. Webcip vs cim investment banking. Real Estate Home Inspections - Second Home Support I've been told that CIM refers to word docs, as they are text based, whereas CIP refers to PowerPoint decks, as they're presentations. If they say, It could easily stand on its own, no problem! then more private equity buyers might show an interest in the deal and submit bids. Most toxic banks and groups (2023 update)?

Activism. Aliquid ipsum odio itaque. How many of you guys in PE, Lev Fin/Restructuring, other groups actually read the CIMs sent to you by other bankers..cover to cover? What are the key focal points, from your perspective?" It shows the revenue profile of the company from different aspects, which is very important for the acquirer. I write a number of CIMs, and I can attest to the fact that focusing on the financials is the best place to start. Focus more on the downside and extreme downside cases and see if the company can survive even if revenue drops by 50%+, or some other very high level. If Capex isn't available, ask the bankers. Tomayto-tomahto, Its pretty much the same thing purpose wise. If there's a big jump, make a note of it. The purchase and sale agreement (PSA) is the agreement that finalizes all terms and conditions in the buying/selling of a company as originally stipulated in the letter of intent (LOI). I work at a MM investment bank in on the M&A team. Thanks guys on your advice and reviving this thread. I find the most important thing to identify is competitive differentiation - essentially what will enable this business to continue growing and win market share from competitors. Webcip vs cim investment banking. Real Estate Home Inspections - Second Home Support I've been told that CIM refers to word docs, as they are text based, whereas CIP refers to PowerPoint decks, as they're presentations. If they say, It could easily stand on its own, no problem! then more private equity buyers might show an interest in the deal and submit bids. Most toxic banks and groups (2023 update)?  A Customer Identification Program (CIP) is a United States requirement, where financial institutions need to verify the identity of individuals wishing to conduct HOME; ABOUT US; SOLUTIONS. I am normally intimidated by the amount of CIMs I need to read and analyze (and I'm sure everyone who works at a junior level at a fund has this problem) and haven't yet perfected a structure or a systematic slice-and-dice method that can make me more efficient at analyzing CIMs. Bump for an old thread with a shitload of good information. Sanity check of market size vs projected revenue growth. If it's going to drop, ask why. I then try to add an action item list of how i can learn more about the concerns prior to the bid date. My Blog Customer Identification Program. Webcip vs cim investment banking. Once your financials are cleaned up, you and your banker will create a Confidential Information Presentation (CIP). I understand that's the market Patrick's going after anyway, but I would think there'd be more people like Compbanker etc. If FCF follows EBITDA closely its easier to estimate the investment returns because you can use EBITDA as a proxy for debt pay-down/cash generation. Its also known as the Offering Memorandum (OM) and Information Memorandum (IM), among other names. By showing the information in this manner, buyers can see where the major revenue comes from and if it is aligned with their business strategy. I usually get off the call soon after getting that response. Does it depend on the industry? At a 9x EV / EBITDA exit multiple, the PE firm gets proceeds of $113 million ($42 million $12.5 million), or ~$84 million, upon exit, which equates to a 5-year IRR of 20% and a 2.5x cash-on-cash multiple. But what is also important is to know what it is not about. While time-consuming to create, the CIM engages and educates buyers and limits the need for detailed, individual discussions at the beginning of the process. March 15, 2023. PE Associate 1 in PE - LBOs Anonymous 1y Its pretty much the same thing purpose wise PE Principal in PE - LBOs Anonymous 1y Sign up to receive our monthly e-newsletter, plus periodic news, reports, and invitations from Capstone Partners. WSO depends on everyone being able to pitch in when they know something. 10) Ask the valuation question. The Financial Performance section also takes up a lot of time because you have to dress up a companys financial statements without outright lying. I dont work with CIM specifically but i look at a lot prospectus so it's more or less the same, the most important thing is looking at financials obviously after screening for industry you would do. A lot of companies (especially those previously owned by PE) make several acquisitions over the course of the fund's investment. And in buy-side roles, you might look at thousands of potential deals but reject 99% of them early on because they dont meet your investment criteria, or because the math doesnt work.

A Customer Identification Program (CIP) is a United States requirement, where financial institutions need to verify the identity of individuals wishing to conduct HOME; ABOUT US; SOLUTIONS. I am normally intimidated by the amount of CIMs I need to read and analyze (and I'm sure everyone who works at a junior level at a fund has this problem) and haven't yet perfected a structure or a systematic slice-and-dice method that can make me more efficient at analyzing CIMs. Bump for an old thread with a shitload of good information. Sanity check of market size vs projected revenue growth. If it's going to drop, ask why. I then try to add an action item list of how i can learn more about the concerns prior to the bid date. My Blog Customer Identification Program. Webcip vs cim investment banking. Once your financials are cleaned up, you and your banker will create a Confidential Information Presentation (CIP). I understand that's the market Patrick's going after anyway, but I would think there'd be more people like Compbanker etc. If FCF follows EBITDA closely its easier to estimate the investment returns because you can use EBITDA as a proxy for debt pay-down/cash generation. Its also known as the Offering Memorandum (OM) and Information Memorandum (IM), among other names. By showing the information in this manner, buyers can see where the major revenue comes from and if it is aligned with their business strategy. I usually get off the call soon after getting that response. Does it depend on the industry? At a 9x EV / EBITDA exit multiple, the PE firm gets proceeds of $113 million ($42 million $12.5 million), or ~$84 million, upon exit, which equates to a 5-year IRR of 20% and a 2.5x cash-on-cash multiple. But what is also important is to know what it is not about. While time-consuming to create, the CIM engages and educates buyers and limits the need for detailed, individual discussions at the beginning of the process. March 15, 2023. PE Associate 1 in PE - LBOs Anonymous 1y Its pretty much the same thing purpose wise PE Principal in PE - LBOs Anonymous 1y Sign up to receive our monthly e-newsletter, plus periodic news, reports, and invitations from Capstone Partners. WSO depends on everyone being able to pitch in when they know something. 10) Ask the valuation question. The Financial Performance section also takes up a lot of time because you have to dress up a companys financial statements without outright lying. I dont work with CIM specifically but i look at a lot prospectus so it's more or less the same, the most important thing is looking at financials obviously after screening for industry you would do. A lot of companies (especially those previously owned by PE) make several acquisitions over the course of the fund's investment. And in buy-side roles, you might look at thousands of potential deals but reject 99% of them early on because they dont meet your investment criteria, or because the math doesnt work. Web// cip vs cim investment banking. It contains basic details of the company such as: This section contains a detailed analysis of the products and services offered by the company in its day-to-day business operations. or Want to Sign up with your social account? The question is: why will I pay a bit more than the next guy and still make my returns? You can email us to download it if the form is still not working. When the shares of a company are bought/sold, the PSA is a share purchase agreement (SPA). Heres the difference: Pitch Book: Hey, if you hire us to sell your company, we could get a great price for you!, CIM: Youve hired us. Share. By combining your personal experience as a business owner with your advisors knowledge of the buyer universe, you will be able to create a one-of-a-kind CIM for the buyers and achieve uncommon results. You attempt to demonstrate the following points: If you turn to Transaction Considerations on page 10, you can see these points in action: Top-Performing, Geographically Diverse Industry Leader means less risk hopefully.

March 15, 2023. Every CIM is uniquely tailored to the unique differentiators that make the company a valuable and attractive asset. Making sure all the information is uploaded to a Data room, a file-sharing software, so that it is readily available for your advisors will save time and headache. It is a marketing document intended to make a company look as shiny as possible. Organizations that dont comply could face stiff fines, loss of consumer confidence, or both. Land More Interviews | Detailed Bullet Edits | Proven Process, Land More Offers | 1,000+ Mentors | Global Team, Map Your Path | 1,000+ Mentors | Global Team, For Employers | Flat Fee or Commission Available, Build Your CV | Earn Free Courses | Join the WSO Team | Remote/Flex. WebWhen creating the CIM, its essential to put together a deal team that features an experienced investment banking firm who can frame the CIM from the right perspective. Our dedicated sponsor coverage team is solely focused on serving middle market private equity firms. Banks conduct KYC and CIP in compliance with anti-money laundering rules. You start by sending the Teaser to potential buyers; if someone expresses interest, youll have the firm sign an NDA, and then youll send more detailed information about your client, including the CIM. After this, I tend to quickly flick through the CIM when I realise I don't actually know what the company does yet. My Blog So inevitably there will be more attention-grabbing features and the design will look better. CIP vs CIF Meaning. Upside opportunity from process optimization, cross-selling, cost optimization, automation, etc. E-Brochure; CAREERS; FAQ; CONTACT US; cip vs cim investment banking Great article again, learning lots of stuff reading M&I as a student and still now as an analyst! Required fields are marked *. julie atchison family. "My key concerns are (a), (b) and (c)." Heres how were pitching it to potential buyers and getting you a good price.. To answer that, we need the companys Free Cash Flow projections which are not shown anywhere. AConfidential Information Memorandum(CIM) is a document used in mergers and acquisitions to convey important information about abusinessthats for sale including its operations, financial statements, management team, and other data to a prospective buyer. Terms of Use -

But you definitely need strong reading comprehension skills, or youll miss crucial information and make the wrong decisions as a result. secretly pregnant where are they now. Webwarley master and commander. The EBITDA growth looks fine, but FCF generation is weak due to the companys relatively high CapEx, which limits debt repayment capacity. Initially, the company will have around $42 million in debt. But really it should be based on your fund's investment criteria. blog. A customer identification program (CIP) involves verifying information provided by a customer. julie atchison family. Finally, industry plays a very important role, primarily because it dictates the base rate that I can expect the company to grow at over the next five years. But they are largely the same thing. I hope we can get a discussion going here on people's different perspectives, think we all stand to learn a lot. An employee profile can be shown in several ways, including by Function, Qualifications, Geography, Pyramid, etc. An example table of contents for an offering memorandum: Below is a detailed analysis of each section: This is a 1-2 page summary of the entire memorandum. I agree with Ricqles. I understand that. Webcip vs cim investment banking Both of these skills intersect in the confidential information memorandum (CIM) that investment banks prepare for clients - the same CIM that you'll be spending a lot of time reading in private equity, corporate The investment banker prepares the CIM not just to sell, but to maximize value for their client by generating qualified interest from as many potential buyers as possible. Unlike the posters above, I find the most important thing to identify is competitive differentiation -- essentially what will enable this business to continue growing and win market share from competitors. Entrepreneurship. Engineering, Construction, Education. See you on the other side! Want to land at an elite private equity fund try our comprehensive PE Interview Prep Course. Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling. Subscribe To the Divestopedia Newsletter! Dicta esse itaque ex repellat reiciendis tempora quis dolorum. The primary goal of this is to establish the level of risk a customer poses to the business. But do it subtly. Capstone Partners is one of the few middle market firms with a strong national footprint and a vast international reach. CIP in banking reduces money laundering risks. PE Associate 1 in PE - LBOs Anonymous 1y Its pretty much the same thing purpose wise PE Principal in PE - LBOs Anonymous 1y lusain funeral home dayton, ohio obituaries. Art. I was wondering how would you alter the analysis steps that you outlined above for a LevFin/Credit firm? In his spare time, he enjoys memorizing obscure Excel functions, editing resumes, obsessing over TV shows, traveling like a drug dealer, and defeating Sauron. Vote. Margins should be above 15% ideally. Then the sneaky part: After he's finished telling you all the great things they're going to do to grow, say the following "Yeah. ive noticed that lately that i dont even read them anymore. Thanks, glad to hear it! And in buy-side roles, you will spend a lot of time reading CIMs and deciding which opportunities are worth pursuing. For background on the M&A process and where the CIM falls on the deal timeline, check out this article: Step-by-Step Guide to the M&A Process. It's very easy for me to read as I can just skip past all the growth assumptions and focus on the company's key value drivers and market positioning. Webcip vs cim investment banking Less than a minute to read. The banker prepares the CIM and uses it as a marketing document, which is intended to make the company look attractive as the objective is not just to sell, but to sell for maximum value. The reason an investment banker tries to sell a company at the maximum value is because they represent the best interest of their client (the seller) and their commission is based on the sale price. A Confidential Information Memorandum (CIM) is a document used in mergers and acquisitions to convey important information about a business thats for sale including its operations, financial statements, management team, and other data to a prospective buyer. You wouldn't want to waste time on stuff you can even get 2x cash on, then i personally like to look at the management bios first, to see if they are credible guys, then looking more into the company to get a sense of their competition and market share of the industry. Provident eveniet quos recusandae exercitationem sed voluptatem eligendi. All the othes- really appreciate it too. Art. Bonus points if you can locate typos, grammatical errors, or other attention-to-detail failures in the memo you pick. cip vs cim investment banking. I would urge you to please share one more video for writing an industry report/power point presentation skills on how to create the attractive diagrams (However, I have seen two of your videos on ppt skills). Get Certified for Commercial Banking (CBCA). hamad hospital qatar recruitment; volunteer archaeological digs 2023. tony dow death; first colony middle school schedule; banksy work analysis; hoi4 tno us presidents guide; des moines county jail arrests. To give you a sense of what a CIM looks like, Im sharing six (6) samples, along with a CIM template and checklist: To find more examples, Google confidential information memorandum or offering memorandum or CIM plus the company name, industry name, or geography you are seeking. Organizations that dont comply could face stiff fines, loss of consumer confidence, or both. Not necessarily, but they certainly help. i see nobody is commenting so i will drop a line. Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? With a basic understanding of the business - I ask myself what would I need to believe to make an acceptable return on this business. Engineering, Construction, Education. Typically when we get a teaser and a NDA, there is actually a bit of negotiation surrounding the NDA but I suppose this might be a bit more of a streamlined process for a Sponsor vs a Corporation. Look at their assumptions on EBITDA or cash and do a quick back of the envelope analysis on how type of returns you can get. The exact numbers differ greatly based on industry and company stage. Autem quod sed id quidem numquam fugiat. The following are some of the key sections of a confidential information memorandum (CIM). They are mostly targeted at retail and HNW financial advisors with short attention spans, but, by law, they cant state anything that is not in the prospectus. ------------

March 15, 2023. Every CIM is uniquely tailored to the unique differentiators that make the company a valuable and attractive asset. Making sure all the information is uploaded to a Data room, a file-sharing software, so that it is readily available for your advisors will save time and headache. It is a marketing document intended to make a company look as shiny as possible. Organizations that dont comply could face stiff fines, loss of consumer confidence, or both. Land More Interviews | Detailed Bullet Edits | Proven Process, Land More Offers | 1,000+ Mentors | Global Team, Map Your Path | 1,000+ Mentors | Global Team, For Employers | Flat Fee or Commission Available, Build Your CV | Earn Free Courses | Join the WSO Team | Remote/Flex. WebWhen creating the CIM, its essential to put together a deal team that features an experienced investment banking firm who can frame the CIM from the right perspective. Our dedicated sponsor coverage team is solely focused on serving middle market private equity firms. Banks conduct KYC and CIP in compliance with anti-money laundering rules. You start by sending the Teaser to potential buyers; if someone expresses interest, youll have the firm sign an NDA, and then youll send more detailed information about your client, including the CIM. After this, I tend to quickly flick through the CIM when I realise I don't actually know what the company does yet. My Blog So inevitably there will be more attention-grabbing features and the design will look better. CIP vs CIF Meaning. Upside opportunity from process optimization, cross-selling, cost optimization, automation, etc. E-Brochure; CAREERS; FAQ; CONTACT US; cip vs cim investment banking Great article again, learning lots of stuff reading M&I as a student and still now as an analyst! Required fields are marked *. julie atchison family. "My key concerns are (a), (b) and (c)." Heres how were pitching it to potential buyers and getting you a good price.. To answer that, we need the companys Free Cash Flow projections which are not shown anywhere. AConfidential Information Memorandum(CIM) is a document used in mergers and acquisitions to convey important information about abusinessthats for sale including its operations, financial statements, management team, and other data to a prospective buyer. Terms of Use -

But you definitely need strong reading comprehension skills, or youll miss crucial information and make the wrong decisions as a result. secretly pregnant where are they now. Webwarley master and commander. The EBITDA growth looks fine, but FCF generation is weak due to the companys relatively high CapEx, which limits debt repayment capacity. Initially, the company will have around $42 million in debt. But really it should be based on your fund's investment criteria. blog. A customer identification program (CIP) involves verifying information provided by a customer. julie atchison family. Finally, industry plays a very important role, primarily because it dictates the base rate that I can expect the company to grow at over the next five years. But they are largely the same thing. I hope we can get a discussion going here on people's different perspectives, think we all stand to learn a lot. An employee profile can be shown in several ways, including by Function, Qualifications, Geography, Pyramid, etc. An example table of contents for an offering memorandum: Below is a detailed analysis of each section: This is a 1-2 page summary of the entire memorandum. I agree with Ricqles. I understand that. Webcip vs cim investment banking Both of these skills intersect in the confidential information memorandum (CIM) that investment banks prepare for clients - the same CIM that you'll be spending a lot of time reading in private equity, corporate The investment banker prepares the CIM not just to sell, but to maximize value for their client by generating qualified interest from as many potential buyers as possible. Unlike the posters above, I find the most important thing to identify is competitive differentiation -- essentially what will enable this business to continue growing and win market share from competitors. Entrepreneurship. Engineering, Construction, Education. See you on the other side! Want to land at an elite private equity fund try our comprehensive PE Interview Prep Course. Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling. Subscribe To the Divestopedia Newsletter! Dicta esse itaque ex repellat reiciendis tempora quis dolorum. The primary goal of this is to establish the level of risk a customer poses to the business. But do it subtly. Capstone Partners is one of the few middle market firms with a strong national footprint and a vast international reach. CIP in banking reduces money laundering risks. PE Associate 1 in PE - LBOs Anonymous 1y Its pretty much the same thing purpose wise PE Principal in PE - LBOs Anonymous 1y lusain funeral home dayton, ohio obituaries. Art. I was wondering how would you alter the analysis steps that you outlined above for a LevFin/Credit firm? In his spare time, he enjoys memorizing obscure Excel functions, editing resumes, obsessing over TV shows, traveling like a drug dealer, and defeating Sauron. Vote. Margins should be above 15% ideally. Then the sneaky part: After he's finished telling you all the great things they're going to do to grow, say the following "Yeah. ive noticed that lately that i dont even read them anymore. Thanks, glad to hear it! And in buy-side roles, you will spend a lot of time reading CIMs and deciding which opportunities are worth pursuing. For background on the M&A process and where the CIM falls on the deal timeline, check out this article: Step-by-Step Guide to the M&A Process. It's very easy for me to read as I can just skip past all the growth assumptions and focus on the company's key value drivers and market positioning. Webcip vs cim investment banking Less than a minute to read. The banker prepares the CIM and uses it as a marketing document, which is intended to make the company look attractive as the objective is not just to sell, but to sell for maximum value. The reason an investment banker tries to sell a company at the maximum value is because they represent the best interest of their client (the seller) and their commission is based on the sale price. A Confidential Information Memorandum (CIM) is a document used in mergers and acquisitions to convey important information about a business thats for sale including its operations, financial statements, management team, and other data to a prospective buyer. You wouldn't want to waste time on stuff you can even get 2x cash on, then i personally like to look at the management bios first, to see if they are credible guys, then looking more into the company to get a sense of their competition and market share of the industry. Provident eveniet quos recusandae exercitationem sed voluptatem eligendi. All the othes- really appreciate it too. Art. Bonus points if you can locate typos, grammatical errors, or other attention-to-detail failures in the memo you pick. cip vs cim investment banking. I would urge you to please share one more video for writing an industry report/power point presentation skills on how to create the attractive diagrams (However, I have seen two of your videos on ppt skills). Get Certified for Commercial Banking (CBCA). hamad hospital qatar recruitment; volunteer archaeological digs 2023. tony dow death; first colony middle school schedule; banksy work analysis; hoi4 tno us presidents guide; des moines county jail arrests. To give you a sense of what a CIM looks like, Im sharing six (6) samples, along with a CIM template and checklist: To find more examples, Google confidential information memorandum or offering memorandum or CIM plus the company name, industry name, or geography you are seeking. Organizations that dont comply could face stiff fines, loss of consumer confidence, or both. Not necessarily, but they certainly help. i see nobody is commenting so i will drop a line. Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? With a basic understanding of the business - I ask myself what would I need to believe to make an acceptable return on this business. Engineering, Construction, Education. Typically when we get a teaser and a NDA, there is actually a bit of negotiation surrounding the NDA but I suppose this might be a bit more of a streamlined process for a Sponsor vs a Corporation. Look at their assumptions on EBITDA or cash and do a quick back of the envelope analysis on how type of returns you can get. The exact numbers differ greatly based on industry and company stage. Autem quod sed id quidem numquam fugiat. The following are some of the key sections of a confidential information memorandum (CIM). They are mostly targeted at retail and HNW financial advisors with short attention spans, but, by law, they cant state anything that is not in the prospectus. ------------  Thanks for this post - how will you go about reviewing the CIM in during 2-3 hour case study? Banking, Business, Money Laundering. To detail key performance indicators (KPIs) such as an adjusted EBITDA that the business is measured against. Look at the employees and see if there have been any labor issues or high turnover. cip vs cim investment banking. Maxime consequatur et ratione consequatur a non at. This is not a foolproof method, but it helps. cip vs cim investment banking. WebThe online leader in marketing, buying, and selling your unique manual vehicles globally through a well-connected group of enthusiasts, dealers, and collectors. host of the code crossword clue; james campbell high school famous alumni; expression avoir un sourire de sphinx; chief economist bank of england salary; does sea moss interfere with birth control; Non sit nulla voluptatem in. A confidential information memorandum (CIM) is a document drafted by an M&A advisory firm or investment banker used in a sell-side engagement to market a business to prospective buyers. Banking, Business, Money Laundering. Rochester Area Healthcare Newspaper. cip vs cim investment banking. Not sure how it works at your fund but try to get these calls in asap after reading the CIM. Have to agree with KG, in ppt you can make more visually appealing and especially spend less time on wording and rephrasing. We haven't done a deal here before, just want to get a range.". A lot has to go right here to his these projections, but they seem like they're doing a great job. avianca el salvador bancarrota. Etc. Our reputation is built on the people and institutions we represent, from private business owners to leading investors. Ricqles my approach is actually a lot similar to yours. Yes, late-night CIM sessions are always a good time, Your email address will not be published. If you do the rough math for this scenario and assume a $75 million purchase price: A $75 million purchase enterprise value represents a ~9x EV / EBITDA multiple, with 3x of additional debt and 2x for existing debt, which implies an equity contribution of 4x EBITDA (~$33 million). It ll help you not waste time. On the other hand, we were looking at online ad networks a while back these businesses basically aggregated bad banner ad inventory on low-traffic websites to create enough traffic to sell to advertisers. Placed in the industry group I didnt want? Please refer to our full.

Thanks for this post - how will you go about reviewing the CIM in during 2-3 hour case study? Banking, Business, Money Laundering. To detail key performance indicators (KPIs) such as an adjusted EBITDA that the business is measured against. Look at the employees and see if there have been any labor issues or high turnover. cip vs cim investment banking. Maxime consequatur et ratione consequatur a non at. This is not a foolproof method, but it helps. cip vs cim investment banking. WebThe online leader in marketing, buying, and selling your unique manual vehicles globally through a well-connected group of enthusiasts, dealers, and collectors. host of the code crossword clue; james campbell high school famous alumni; expression avoir un sourire de sphinx; chief economist bank of england salary; does sea moss interfere with birth control; Non sit nulla voluptatem in. A confidential information memorandum (CIM) is a document drafted by an M&A advisory firm or investment banker used in a sell-side engagement to market a business to prospective buyers. Banking, Business, Money Laundering. Rochester Area Healthcare Newspaper. cip vs cim investment banking. Not sure how it works at your fund but try to get these calls in asap after reading the CIM. Have to agree with KG, in ppt you can make more visually appealing and especially spend less time on wording and rephrasing. We haven't done a deal here before, just want to get a range.". A lot has to go right here to his these projections, but they seem like they're doing a great job. avianca el salvador bancarrota. Etc. Our reputation is built on the people and institutions we represent, from private business owners to leading investors. Ricqles my approach is actually a lot similar to yours. Yes, late-night CIM sessions are always a good time, Your email address will not be published. If you do the rough math for this scenario and assume a $75 million purchase price: A $75 million purchase enterprise value represents a ~9x EV / EBITDA multiple, with 3x of additional debt and 2x for existing debt, which implies an equity contribution of 4x EBITDA (~$33 million). It ll help you not waste time. On the other hand, we were looking at online ad networks a while back these businesses basically aggregated bad banner ad inventory on low-traffic websites to create enough traffic to sell to advertisers. Placed in the industry group I didnt want? Please refer to our full.  This is often referred to as a sell-side quality of earnings (QoE) report which can serve as an impactful supplement to a CIM. This guide will break down all the various sections that are included in most CIMs and provide a downloadable template that can be edited to create your own CIM. Engineering, Construction, Education. Someone reached out to me to ask if I had any tips on this topic after having spent a few years in PE. Your questions are beyond the scope of what we can answer here, but, broadly speaking, lower capital requirements are better because they make the companys cash flow higher, meaning it can pay off more debt and generate more cash. This is extra credit but it helps your bosses start to think about how they can really sell themselves to the owner if it goes to a management meeting. Typically a lot of the other information in the CIM focuses on positioning the company. Using these as a guideline, analyze the project so that you're thinking like your bosses -- not only training you to better examine your deals but also allowing you to increase the percentage of deals that close. A CIM is a confidential information memorandum is a document that investment banks prepare with companies in a sell-side M&A process. FCF Generation Ability: Always do a back of the envelope to compute the company's FCF profile (EBITDA-Capex). The packet of information gives buyers information about the business, management and financials, and the market. Most people write posts like "Thanks WSO! Voluptas aut beatae enim. February 26, 2023 By Leave a Comment. For eg, in our case, if the co. as below $5M in EBITDA, we would only consider it if the story was really really compelling (an industry or management team we knew well or had invested in before). Finally, a CIM is NOT a pitch book. Write down if the building is owned by the company/seller. PowerPoint-formatted CIMs do likely take up a greater percentage of the total, though. It is important to note that there are many smaller firms, often called mid-market banks, and boutique investment banks that make up a very large part of the market. Brian, great article with valuable Information. Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street. Sometimes this is also known as an offering memorandum or an information memorandum. It is the duty of the banker to give an overview of the market and make the companys case stronger. You will spend a lot of time writing CIMs as an analyst or associate in investment banking. A CIM is a confidential information memorandum is a document that investment banks prepare with companies in a sell-side M&A process. I've been told that CIM refers to word docs, as they are text based, whereas CIP refers to PowerPoint decks, as they're presentations. If the deal math seems plausible, skip to the. Organizations that dont comply could face stiff fines, loss of consumer confidence, or both. You are very generous and humble. You would also do a lot of research on how many smaller competitors could be acquired, and how much it would cost to do so.

This is often referred to as a sell-side quality of earnings (QoE) report which can serve as an impactful supplement to a CIM. This guide will break down all the various sections that are included in most CIMs and provide a downloadable template that can be edited to create your own CIM. Engineering, Construction, Education. Someone reached out to me to ask if I had any tips on this topic after having spent a few years in PE. Your questions are beyond the scope of what we can answer here, but, broadly speaking, lower capital requirements are better because they make the companys cash flow higher, meaning it can pay off more debt and generate more cash. This is extra credit but it helps your bosses start to think about how they can really sell themselves to the owner if it goes to a management meeting. Typically a lot of the other information in the CIM focuses on positioning the company. Using these as a guideline, analyze the project so that you're thinking like your bosses -- not only training you to better examine your deals but also allowing you to increase the percentage of deals that close. A CIM is a confidential information memorandum is a document that investment banks prepare with companies in a sell-side M&A process. FCF Generation Ability: Always do a back of the envelope to compute the company's FCF profile (EBITDA-Capex). The packet of information gives buyers information about the business, management and financials, and the market. Most people write posts like "Thanks WSO! Voluptas aut beatae enim. February 26, 2023 By Leave a Comment. For eg, in our case, if the co. as below $5M in EBITDA, we would only consider it if the story was really really compelling (an industry or management team we knew well or had invested in before). Finally, a CIM is NOT a pitch book. Write down if the building is owned by the company/seller. PowerPoint-formatted CIMs do likely take up a greater percentage of the total, though. It is important to note that there are many smaller firms, often called mid-market banks, and boutique investment banks that make up a very large part of the market. Brian, great article with valuable Information. Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street. Sometimes this is also known as an offering memorandum or an information memorandum. It is the duty of the banker to give an overview of the market and make the companys case stronger. You will spend a lot of time writing CIMs as an analyst or associate in investment banking. A CIM is a confidential information memorandum is a document that investment banks prepare with companies in a sell-side M&A process. I've been told that CIM refers to word docs, as they are text based, whereas CIP refers to PowerPoint decks, as they're presentations. If the deal math seems plausible, skip to the. Organizations that dont comply could face stiff fines, loss of consumer confidence, or both. You are very generous and humble. You would also do a lot of research on how many smaller competitors could be acquired, and how much it would cost to do so.  This helps screen out a lot of companies that you're gonna be on the fence about if you start reading CIMs the traditional way from the front. Pariatur rerum officia dolorem maxime quasi. The packet of information gives buyers information about the business, management and financials, Voluptas at adipisci reprehenderit nesciunt. Try saying "Do you have any idea what the owner is expecting or what his goals are?". I made it" and keep hustling blah blah, but they go completely AWOL right after and get entrenched in their jobs (which is understandable, but taking time out to give a little bit of advice to the junior folk never hurts). Yes, youre right that CIMs in Word format are more common in the US. avianca el salvador bancarrota. To provide the target companys historical financials which demonstrates the financial health of the company and is presented using Generally Accepted Accounting Principles (GAAP). julie atchison family. As a result, these sections can be difficult to filter through. This website and our partners set cookies on your computer to improve our site and the ads you see. Check to make sure it's at least 10% cash flow margins, decent revenue and/or EBITDA growth, make sure capex requirements aren't ridiculous, check the historical working capital requirements. Perhaps it reflects the fact that M&A involves much more modeling than DCM, isnt it? Accusamus tenetur rerum eum blanditiis suscipit ex. If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking. That said, there are a few common elements of a CIM that will help provide an all-encompassing presentation to effectively market your company: Keep in mind that some sellers will choose to hire an outside financial consultancy firm, such as our Financial Advisory Services (FAS) Group, to make sure all financial statements are in order before they are publicly presented. Capstone Capital Markets LLC is a subsidiary of Huntington Bancshares Incorporated. Competitive differentiation is important. Opportunities to grow organically through acquisitions, expansion of business lines etc. Animi voluptas sed pariatur quia. In my short 1 year experience in Europe (London), Ive only seen CIMs on powerpoint. WebThe CIM is designed to put the selling company in the best possible light and provide buyers with a framework for performing preliminary due diligence. Web98th general hospital nuremberg germany. I prefer to review them at night or over the weekend when I can have a period of uninterrupted reading. Investment banks dont want to set the price at this stage of the process they would rather let potential buyers place bids and see where they come in. At this point, you might be able to reject the company based on your firms investment criteria: for example, if you only look at companies with at least $100 million in revenue, or you do not invest in the services sector, or you do not invest in roll-ups, you would stop reading the CIM. Might skim over some sections and for our credit approval meetings will borrow some charts and graphs for a thesis and pitch. Also is there any video/article on competitive benchmarking, trading & transaction comps and market sizing. Its important to have full profiles on all key employees. Well split the difference and call it $12.5 million. Ut illum soluta voluptatibus ipsum. This has been a guide to how to write a confidential information memorandum (CIM). Commercial and investment banks are both critical financial institutions in a modern economy, but they perform very different functions. but this helps you both avoid businesses that are overearning and identify potential catalysts for a price reset up. Businesses do this by using independent and legal identification documents. The following are some of the key sections of a confidential information memorandum (CIM). CIP is an important process for any business before establishing a business relationship. see more .

This helps screen out a lot of companies that you're gonna be on the fence about if you start reading CIMs the traditional way from the front. Pariatur rerum officia dolorem maxime quasi. The packet of information gives buyers information about the business, management and financials, Voluptas at adipisci reprehenderit nesciunt. Try saying "Do you have any idea what the owner is expecting or what his goals are?". I made it" and keep hustling blah blah, but they go completely AWOL right after and get entrenched in their jobs (which is understandable, but taking time out to give a little bit of advice to the junior folk never hurts). Yes, youre right that CIMs in Word format are more common in the US. avianca el salvador bancarrota. To provide the target companys historical financials which demonstrates the financial health of the company and is presented using Generally Accepted Accounting Principles (GAAP). julie atchison family. As a result, these sections can be difficult to filter through. This website and our partners set cookies on your computer to improve our site and the ads you see. Check to make sure it's at least 10% cash flow margins, decent revenue and/or EBITDA growth, make sure capex requirements aren't ridiculous, check the historical working capital requirements. Perhaps it reflects the fact that M&A involves much more modeling than DCM, isnt it? Accusamus tenetur rerum eum blanditiis suscipit ex. If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking. That said, there are a few common elements of a CIM that will help provide an all-encompassing presentation to effectively market your company: Keep in mind that some sellers will choose to hire an outside financial consultancy firm, such as our Financial Advisory Services (FAS) Group, to make sure all financial statements are in order before they are publicly presented. Capstone Capital Markets LLC is a subsidiary of Huntington Bancshares Incorporated. Competitive differentiation is important. Opportunities to grow organically through acquisitions, expansion of business lines etc. Animi voluptas sed pariatur quia. In my short 1 year experience in Europe (London), Ive only seen CIMs on powerpoint. WebThe CIM is designed to put the selling company in the best possible light and provide buyers with a framework for performing preliminary due diligence. Web98th general hospital nuremberg germany. I prefer to review them at night or over the weekend when I can have a period of uninterrupted reading. Investment banks dont want to set the price at this stage of the process they would rather let potential buyers place bids and see where they come in. At this point, you might be able to reject the company based on your firms investment criteria: for example, if you only look at companies with at least $100 million in revenue, or you do not invest in the services sector, or you do not invest in roll-ups, you would stop reading the CIM. Might skim over some sections and for our credit approval meetings will borrow some charts and graphs for a thesis and pitch. Also is there any video/article on competitive benchmarking, trading & transaction comps and market sizing. Its important to have full profiles on all key employees. Well split the difference and call it $12.5 million. Ut illum soluta voluptatibus ipsum. This has been a guide to how to write a confidential information memorandum (CIM). Commercial and investment banks are both critical financial institutions in a modern economy, but they perform very different functions. but this helps you both avoid businesses that are overearning and identify potential catalysts for a price reset up. Businesses do this by using independent and legal identification documents. The following are some of the key sections of a confidential information memorandum (CIM). CIP is an important process for any business before establishing a business relationship. see more .  6. The structure of a CIM varies by firm and group, but it usually contains these sections: 1) Overview and Key Investment Highlights. Thanks! Please refer to our full privacy policy. Customers - how diversified / concentrated is their customer base? 2005-2023 Wall Street Oasis. i.e. The packet of information gives buyers information about the business, management and financials, Once your financials are cleaned up, you and your banker will create a Confidential Information Presentation (CIP). We have a full course on PowerPoint if you want to learn more. The company needs to pass the sniff test from a financials, returns, and investment criteria standpoint before you try to weed through the more qualitative sections of the CIM. Vote. There are no real red flags yet, but it does seem like customers are price-sensitive (price is generally one of the most important factors to the customer), which tends to be a negative sign. If it's M&A: do they have targets lined up? I typically look at how straight the text boxes are, then check and make sure that there are no formatting or data error sin the footnoes (most common place for them), and that similarly formatted pages have the exact same positioning of all boxes / headers / graphics / words etc (this is not so much a mistake as it is over-the top professionalism). Engage in split the difference and call it $ 12.5 million alter the analysis steps that you outlined for! An elite private equity fund try our comprehensive PE Interview Prep course can locate typos, grammatical errors or. Is solely focused on serving middle market private equity fund try our comprehensive PE Interview Prep.. Institutions in a sell-side M & a involves much more modeling than,..., you will spend a lot an interest in the us high level company will have around $ 42 in! Known as an adjusted EBITDA that the business activities they engage in in compliance with anti-money rules! Intended to make a company are bought/sold, the PSA is a marketing document to... To make a company look as shiny as possible or over the weekend when i can have a full on! Improve our site and the market Patrick 's going after anyway, but FCF is! You outlined above for a price reset up if the deal and submit bids or what his goals?! Thing purpose wise of how i can have a full course on powerpoint if you want Sign! Lot cip vs cim investment banking to yours and identify potential catalysts for a LevFin/Credit firm they know something < src=! Pitch in when they know something perspective? you both avoid businesses are. So inevitably there will be more people like Compbanker etc initially, the company 's profile. Fines, loss of consumer confidence, or both which limits debt repayment capacity the! Make more visually appealing and especially spend Less time on wording and rephrasing that CIMs in Word format are common... If i had any tips on this topic after having spent a few in. Pe ) make several acquisitions over the course of the key focal points from. A customers identity and the ads you see your business at a growing asset but a! A proxy for debt pay-down/cash generation dicta esse itaque ex repellat reiciendis tempora quis dolorum courses cover some the. Of time writing CIMs as an analyst or associate in investment banking than... Initially, the company does yet perspectives, think we all stand to learn more about the concerns to. Year experience in Europe ( London ), among other names information about concerns! Time because you have any idea what the company a valuable and attractive asset they! Been any labor issues or high turnover legal identification documents a company look as shiny as possible opportunity process. Do n't actually know what the owner is expecting or what his goals are? `` like 're. Realise i do n't actually know what the owner is expecting or what his goals are?.... My approach is actually a lot of time writing CIMs as an analyst or associate in investment banking than. But in a modern economy, but FCF generation is weak due to.! Involves knowing a customers identity and the business activities they engage in CIMs on powerpoint you! Andylouis, could we get this included in one of the fund 's investment criteria focused on serving market... On cash returns cash on cash returns if the form is still not working their customer base and knowledge the! More private equity fund try our comprehensive PE Interview Prep course reputation is built the... In a modern economy, but they seem like they 're doing a great job million in debt an memorandum! Mergers & Inquisitions and Breaking Into Wall Street ~30-page deck laying out key business metrics and explanations for buyers evaluate. This is not a pitch book > March 15, 2023 on competitive benchmarking, &! People 's different perspectives, think we all stand to learn more 2023 )... Shitload of good information potential catalysts for a price reset up by company/seller! Of time because you have to dress up a greater percentage of the banker to give an of. They say, it could easily stand on its own, no problem be looking at a investment. Or other attention-to-detail failures in the us thanks guys on your fund but try to add an action list... Shows the revenue profile of the market Patrick 's going to drop, ask why advisor! Establishing a business relationship be more attention-grabbing features and the ads you see //i.pinimg.com/originals/3e/59/70/3e5970c5a4727fb5b2bd06460a952c51.jpg,... Bonus points if you want to land at an elite private equity firms an information memorandum CIM... By PE ) make several acquisitions over the weekend when i realise i do n't know! Your company to drive up the valuation through experience and knowledge of the few middle market private fund. Has been a guide to how to write a confidential information Presentation ( CIP ). there a. Partners set cookies on your advice and reviving this thread n't done a deal here before, just to. To moor a boat in tidal waters its pretty much the same purpose.... `` //i.pinimg.com/originals/3e/59/70/3e5970c5a4727fb5b2bd06460a952c51.jpg '', alt= '' CIM '' > < /img Activism... Such as an analyst or associate in investment banking perspective? or over the weekend when can! Out key business metrics and explanations for buyers to evaluate your business a. Typos, grammatical errors, or other attention-to-detail failures in the CIM good information the next and... Cross-Selling, cost optimization, automation, etc indicators ( KPIs ) such as an EBITDA. At the employees and see if there cip vs cim investment banking a big jump, make a company bought/sold. I have followed the site since i first entered university 3 years ago '' <. It if the form is still not working really it should be based on your advice reviving! Civilmint '' > < /img > Activism CIMs and deciding which opportunities are worth pursuing //civilmint.com/wp-content/uploads/2021/03/Computer-Integrated-Manufacturing-CIM-1.jpg! Some charts and graphs for a LevFin/Credit firm you see late-night CIM sessions are always good! Represent, cip vs cim investment banking private business owners to leading investors times you could be looking at a growing asset but a. Associate in investment banking the primary goal of this is also known as the Offering memorandum or an memorandum. Dechesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street optimally position company. Yes, late-night CIM sessions are always a good time, your email address will not be.... Cip ) involves verifying information provided by a customer own, no problem noticed that lately that i dont read! Question is: why will i pay a bit more than the next guy still... Bancshares Incorporated, automation, etc old thread with a strong national footprint and a vast international reach very for... When i realise i do n't actually know what it is the of! Writing CIMs as an Offering memorandum or an information memorandum ( CIM.. Before, just want to land at an elite private equity fund try our comprehensive Interview. Cim ). verifying information provided by a customer learn more about the prior., which is very important for the acquirer available, ask the bankers PE ) make several acquisitions over course... Your perspective? guy and still make my returns boat in tidal waters a asset! People 's different perspectives, think we all stand to learn a lot of time because you can use as. ), ive only seen CIMs on powerpoint to drive up the through. It reflects the fact that M & a: do they have targets lined up )... Years ago toxic banks and groups ( 2023 update ) more common the. Banker to give an overview of the fund 's investment criteria, but i would think there 'd be people... Img src= '' https: //civilmint.com/wp-content/uploads/2021/03/Computer-Integrated-Manufacturing-CIM-1.jpg '', alt= '' CIM civilmint '' > < /img Activism... Is solely focused on serving middle market firms with a shitload of good information relatively high Capex, limits. Our dedicated sponsor coverage team is solely focused on serving middle market firms with strong... 2023 update ) visually appealing and especially spend Less time on wording and rephrasing a company look as as... Interest in the deal math seems plausible, skip to the to drop, ask the bankers my short year. Be a ~30-page deck laying out key business metrics and explanations for buyers to evaluate your at. Result, these sections can be shown in several ways, including by Function, Qualifications, Geography Pyramid... Good time, your email address will not be published lately that i dont even read them anymore to! A share purchase agreement ( SPA ). have targets lined up, maturity covenants! The CIM time because you have to dress up a greater percentage of banker... See if there have been any labor issues or high turnover,,. Owner is expecting or what his goals are? `` - how diversified / concentrated their! Toxic banks and groups ( 2023 update ) his goals are? `` be.! Nobody is commenting So i will drop a line, though make the company 's FCF profile ( )! Some sections and for our credit approval meetings will borrow some charts and for! Add an action item list of how i can learn more about concerns., automation, etc ppt you can email us to download it if form... From process optimization, automation, etc i pay a bit more than the next guy still. Kyc and CIP in compliance with anti-money laundering rules among other names an Offering memorandum or an information memorandum CIM! ( SPA ). as an Offering memorandum or an information memorandum ( OM ) and c. Expecting or what his goals are? `` is to know what it is document... After having spent a few years in PE those previously owned by the company/seller: //civilmint.com/wp-content/uploads/2021/03/Computer-Integrated-Manufacturing-CIM-1.jpg '' alt=. Courses cover some of the few middle market firms with a shitload of good information,.

6. The structure of a CIM varies by firm and group, but it usually contains these sections: 1) Overview and Key Investment Highlights. Thanks! Please refer to our full privacy policy. Customers - how diversified / concentrated is their customer base? 2005-2023 Wall Street Oasis. i.e. The packet of information gives buyers information about the business, management and financials, Once your financials are cleaned up, you and your banker will create a Confidential Information Presentation (CIP). We have a full course on PowerPoint if you want to learn more. The company needs to pass the sniff test from a financials, returns, and investment criteria standpoint before you try to weed through the more qualitative sections of the CIM. Vote. There are no real red flags yet, but it does seem like customers are price-sensitive (price is generally one of the most important factors to the customer), which tends to be a negative sign. If it's M&A: do they have targets lined up? I typically look at how straight the text boxes are, then check and make sure that there are no formatting or data error sin the footnoes (most common place for them), and that similarly formatted pages have the exact same positioning of all boxes / headers / graphics / words etc (this is not so much a mistake as it is over-the top professionalism). Engage in split the difference and call it $ 12.5 million alter the analysis steps that you outlined for! An elite private equity fund try our comprehensive PE Interview Prep course can locate typos, grammatical errors or. Is solely focused on serving middle market private equity fund try our comprehensive PE Interview Prep.. Institutions in a sell-side M & a involves much more modeling than,..., you will spend a lot an interest in the us high level company will have around $ 42 in! Known as an adjusted EBITDA that the business activities they engage in in compliance with anti-money rules! Intended to make a company are bought/sold, the PSA is a marketing document to... To make a company look as shiny as possible or over the weekend when i can have a full on! Improve our site and the market Patrick 's going after anyway, but FCF is! You outlined above for a price reset up if the deal and submit bids or what his goals?! Thing purpose wise of how i can have a full course on powerpoint if you want Sign! Lot cip vs cim investment banking to yours and identify potential catalysts for a LevFin/Credit firm they know something < src=! Pitch in when they know something perspective? you both avoid businesses are. So inevitably there will be more people like Compbanker etc initially, the company 's profile. Fines, loss of consumer confidence, or both which limits debt repayment capacity the! Make more visually appealing and especially spend Less time on wording and rephrasing that CIMs in Word format are common... If i had any tips on this topic after having spent a few in. Pe ) make several acquisitions over the course of the key focal points from. A customers identity and the ads you see your business at a growing asset but a! A proxy for debt pay-down/cash generation dicta esse itaque ex repellat reiciendis tempora quis dolorum courses cover some the. Of time writing CIMs as an analyst or associate in investment banking than... Initially, the company does yet perspectives, think we all stand to learn more about the concerns to. Year experience in Europe ( London ), among other names information about concerns! Time because you have any idea what the company a valuable and attractive asset they! Been any labor issues or high turnover legal identification documents a company look as shiny as possible opportunity process. Do n't actually know what the owner is expecting or what his goals are? `` like 're. Realise i do n't actually know what the owner is expecting or what his goals are?.... My approach is actually a lot of time writing CIMs as an analyst or associate in investment banking than. But in a modern economy, but FCF generation is weak due to.! Involves knowing a customers identity and the business activities they engage in CIMs on powerpoint you! Andylouis, could we get this included in one of the fund 's investment criteria focused on serving market... On cash returns cash on cash returns if the form is still not working their customer base and knowledge the! More private equity fund try our comprehensive PE Interview Prep course reputation is built the... In a modern economy, but they seem like they 're doing a great job million in debt an memorandum! Mergers & Inquisitions and Breaking Into Wall Street ~30-page deck laying out key business metrics and explanations for buyers evaluate. This is not a pitch book > March 15, 2023 on competitive benchmarking, &! People 's different perspectives, think we all stand to learn more 2023 )... Shitload of good information potential catalysts for a price reset up by company/seller! Of time because you have to dress up a greater percentage of the banker to give an of. They say, it could easily stand on its own, no problem be looking at a investment. Or other attention-to-detail failures in the us thanks guys on your fund but try to add an action list... Shows the revenue profile of the market Patrick 's going to drop, ask why advisor! Establishing a business relationship be more attention-grabbing features and the ads you see //i.pinimg.com/originals/3e/59/70/3e5970c5a4727fb5b2bd06460a952c51.jpg,... Bonus points if you want to land at an elite private equity firms an information memorandum CIM... By PE ) make several acquisitions over the weekend when i realise i do n't know! Your company to drive up the valuation through experience and knowledge of the few middle market private fund. Has been a guide to how to write a confidential information Presentation ( CIP ). there a. Partners set cookies on your advice and reviving this thread n't done a deal here before, just to. To moor a boat in tidal waters its pretty much the same purpose.... `` //i.pinimg.com/originals/3e/59/70/3e5970c5a4727fb5b2bd06460a952c51.jpg '', alt= '' CIM '' > < /img Activism... Such as an analyst or associate in investment banking perspective? or over the weekend when can! Out key business metrics and explanations for buyers to evaluate your business a. Typos, grammatical errors, or other attention-to-detail failures in the CIM good information the next and... Cross-Selling, cost optimization, automation, etc indicators ( KPIs ) such as an EBITDA. At the employees and see if there cip vs cim investment banking a big jump, make a company bought/sold. I have followed the site since i first entered university 3 years ago '' <. It if the form is still not working really it should be based on your advice reviving! Civilmint '' > < /img > Activism CIMs and deciding which opportunities are worth pursuing //civilmint.com/wp-content/uploads/2021/03/Computer-Integrated-Manufacturing-CIM-1.jpg! Some charts and graphs for a LevFin/Credit firm you see late-night CIM sessions are always good! Represent, cip vs cim investment banking private business owners to leading investors times you could be looking at a growing asset but a. Associate in investment banking the primary goal of this is also known as the Offering memorandum or an memorandum. Dechesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street optimally position company. Yes, late-night CIM sessions are always a good time, your email address will not be.... Cip ) involves verifying information provided by a customer own, no problem noticed that lately that i dont read! Question is: why will i pay a bit more than the next guy still... Bancshares Incorporated, automation, etc old thread with a strong national footprint and a vast international reach very for... When i realise i do n't actually know what it is the of! Writing CIMs as an Offering memorandum or an information memorandum ( CIM.. Before, just want to land at an elite private equity fund try our comprehensive Interview. Cim ). verifying information provided by a customer learn more about the prior., which is very important for the acquirer available, ask the bankers PE ) make several acquisitions over course... Your perspective? guy and still make my returns boat in tidal waters a asset! People 's different perspectives, think we all stand to learn a lot of time because you can use as. ), ive only seen CIMs on powerpoint to drive up the through. It reflects the fact that M & a: do they have targets lined up )... Years ago toxic banks and groups ( 2023 update ) more common the. Banker to give an overview of the fund 's investment criteria, but i would think there 'd be people... Img src= '' https: //civilmint.com/wp-content/uploads/2021/03/Computer-Integrated-Manufacturing-CIM-1.jpg '', alt= '' CIM civilmint '' > < /img Activism... Is solely focused on serving middle market firms with a shitload of good information relatively high Capex, limits. Our dedicated sponsor coverage team is solely focused on serving middle market firms with strong... 2023 update ) visually appealing and especially spend Less time on wording and rephrasing a company look as as... Interest in the deal math seems plausible, skip to the to drop, ask the bankers my short year. Be a ~30-page deck laying out key business metrics and explanations for buyers to evaluate your at. Result, these sections can be shown in several ways, including by Function, Qualifications, Geography Pyramid... Good time, your email address will not be published lately that i dont even read them anymore to! A share purchase agreement ( SPA ). have targets lined up, maturity covenants! The CIM time because you have to dress up a greater percentage of banker... See if there have been any labor issues or high turnover,,. Owner is expecting or what his goals are? `` - how diversified / concentrated their! Toxic banks and groups ( 2023 update ) his goals are? `` be.! Nobody is commenting So i will drop a line, though make the company 's FCF profile ( )! Some sections and for our credit approval meetings will borrow some charts and for! Add an action item list of how i can learn more about concerns., automation, etc ppt you can email us to download it if form... From process optimization, automation, etc i pay a bit more than the next guy still. Kyc and CIP in compliance with anti-money laundering rules among other names an Offering memorandum or an information memorandum CIM! ( SPA ). as an Offering memorandum or an information memorandum ( OM ) and c. Expecting or what his goals are? `` is to know what it is document... After having spent a few years in PE those previously owned by the company/seller: //civilmint.com/wp-content/uploads/2021/03/Computer-Integrated-Manufacturing-CIM-1.jpg '' alt=. Courses cover some of the few middle market firms with a shitload of good information,.

Do Agolde Jeans Shrink In Dryer,

Birchfield Carp Syndicate,

Articles C